Table of Contents

- What does Datadog do?

- How did Datadog perform in the last quarter?

- Current assessment of Datadog stocks

- Conclusion on Datadog

“Even if the valuation is less convincing, the stock is a potential buy candidate according to HGI criteria. Since the high HGI score is likely to remain unchanged in 2020, Datadog shares (ISIN: US23804L1035) could be an interesting addition to your portfolio after a price setback. This is, of course, provided that organic growth [of 50%] remains convincing.” We came to this conclusion in our first analysis of Datadog in July 2020.

Almost five years have passed since then. Looking at the stock price, however, little seems to have happened. Until recently, Datadog was still a top performer according to HGI criteria. In terms of price, however, not much has really changed overall, despite many ups and downs. While the stock price stood at around $100 in July 2020, it is now just under $120. Within five years, the stock has given investors little cause for celebration, depending on the timing of the analysis, of course.

Source: StocksGuide stock price

However, the company has undergone massive development in the meantime. While at the end of the 2019 fiscal year, revenues of $363 million and an annual loss were still on the books, Datadog now generates revenues of $2.8 billion and a positive EBIT of just under $30 million, albeit a small one. Free cash flow has also grown to an impressive $900 million.

This has naturally led to some changes in the valuation. While we previously considered the stock to be horrendously expensive with an EV/sales ratio of well over 60, the key figures have now normalized significantly. The EV/sales ratio is now around 13, and the multiple – measured in terms of free cash flow – is no longer just under 1,000, but “only” just over 40.

💡 In a nutshell

- Datadog is a leader in the market for infrastructure and application performance monitoring software.

- In recent quarters, revenue growth has slowed amid declining profitability. Research and development expenses in particular rose disproportionately.

- Datadog stocks continue to be highly valued, with a double-digit EV/sales ratio.

It's time to take another look at Datadog. How does it compare to 2020? Is it still an HGI top scorer? How should its current valuation be interpreted, and what can shareholders expect from Datadog in the future? Let's take a look at the stock, which was one of the HGI top scorers not so long ago.

What does Datadog do?

Datadog's business model can be described as a monitoring system for applications and developer software. This means that Datadog provides software that can be used to monitor the IT infrastructure within a company, analyze the performance of specific applications and their user-friendliness, and ensure collaboration between different teams.

Historically, software development and installation have always taken place in so-called silos. These are isolated areas within the company that are separated from other departments. In these silos, developers programmed software individually and isolated from the rest of the company's operations, which could only be tested afterwards. A new process called DevOps attempts to break this sequence and enable different teams to test and implement software in parallel with its development. Problems with the software can also be solved directly during use.

Datadog is one of the companies enabling this progress. By integrating Datadog's many individual tools into the cloud, the company has created a comprehensive monitoring and analysis system that provides transparent, clear, and real-time visibility into the performance of individual applications and the entire infrastructure. At the same time, Datadog's database measures the usage, performance, and activity of individual accounts. Over the years, Datadog has also acquired expertise in cyber security. By constantly monitoring performance and tracking application usage, potential threats can be quickly identified and eliminated. At the same time, existing problems can be quickly counteracted.

How is the Datadog platform used in practice?

A typical example of Datadog's use can be found in large e-commerce platforms: Let's imagine that an online retailer launches a discount campaign with a sharp increase in customer traffic. During the campaign, the website, database, and payment system must function seamlessly—any delay or disruption can lead to lost sales or damage to the company's reputation. This is exactly where Datadog comes in: The platform collects real-time data on server utilization, load times, user interactions, and error sources. Developers and IT teams are immediately alerted when part of the infrastructure deviates from the target values – for example, when requests to the payment service provider are queuing up or a microservice is responding more slowly than usual.

With the help of dashboards, automated alerts, and machine learning, the team can analyze causes, eliminate bottlenecks, and proactively ensure system stability—before the end user even notices anything. This type of real-time monitoring not only increases application availability but also improves the efficiency of the development teams. In addition, conclusions can be drawn about user behavior: Which part of the website is heavily trafficked? Which feature is rarely used or prone to errors?

This precise view of the system is business-critical for companies in an increasingly digitalized world – whether for cloud migrations, app rollouts, or in security-sensitive areas. Datadog thus provides a central interface between operations, development, and security – and is therefore much more than just a monitoring tool.

What are Datadog's particular strengths?

Datadog is ranked as a market leader in application monitoring and AI applications by various independent and renowned analysis firms such as Gartner and The Forrester Wave. Only one other company has a similar market position: Dynatrace.

But what makes these companies – and Datadog in particular – so special? Datadog is a cloud-native company, which means it was developed in the cloud and designed for the cloud. This gives Datadog many advantages. For example, it can access a wide range of data and, according to its own figures, manages trillions of different incidents per hour. This helps the company to use machine learning and artificial intelligence and continuously optimize its software. In addition, Datadog's software, which comprises over 850 applications, is customizable. Companies can roll out individual applications or the entire software suite via Datadog's infrastructure. These software services are billed on a monthly basis according to usage, for example per function, host, test run, or storage unit.

The management of Datadog

The two Datadog founders Olivier Pomel and Alexis Lê-Quôc have been successfully running the company together for 15 years: Pomel as CEO and Lê-Quôc as CTO (Chief Technology Officer). The fact that the two founders are still so actively involved and continue to run the company successfully is extremely positive. They seem to be able to both further develop the product and scale the company. Previously, both worked at the start-up Wireless Generation, which was successfully acquired by News Corp. Thus, both already had successful careers before joining Datadog. The management trio is completed by David Obstler as CFO, who previously served as CFO of TravelClick. He has held numerous positions and worked for various companies in the investment banking sector.

How did Datadog perform in the last quarter?

Let's take a look at the figures for the fourth quarter first. Datadog increased its revenue by a further 25% in the first quarter of 2025. However, it is interesting to note that gross profit did not grow as strongly. This means that Datadog was unable to pass on increased manufacturing costs to customers in the form of price adjustments. When a company has to offer its software at a lower price or is unable to pass on price increases because customers are not willing to pay for them, this usually indicates a shrinking competitive advantage.

In addition, Datadog's EBIT was negative in the first quarter of 2025, whereas it was positive just a year ago. This is mainly due to a sharp increase in research and development expenses. This is also a sign that Datadog needs to invest even more to maintain its market position in the current competitive environment. The entire income statement reads as follows:

Source: Financial data from Datadog

The expenditure on research and development is also reflected in Datadog's acquisition activity. In the first quarter of 2025, the company acquired Eppo and Metaplane, two companies focusing on error reporting, monitoring, and machine learning. Through several acquisitions, particularly in 2022, Datadog has now built up goodwill of around $360 million. This is reported as a separate item within intangible assets on the balance sheet.

Goodwill arises when a company pays more for another company than the sum of its identifiable assets minus its liabilities. It primarily reflects expectations of synergies, brand value or expertise. High goodwill can be an indication of a strategic acquisition – or of a particularly high purchase price that has yet to be justified.

Apart from the high goodwill balance, however, Datadog's balance sheet looks very healthy. The high cash balance alone is sufficient to cover all of the company's short- and long-term liabilities. Datadog's balance sheet is as follows:

Source: Balance Sheet Datadog

Datadog expects revenue growth of between 20% and 21% for the full year 2025. Datadog therefore expects revenue growth to slow further in the course of the year compared to the first quarter. On a positive note for shareholders, Datadog plans to slightly reduce its number of (diluted) outstanding shares compared to the first quarter of 2025.

Source: Stock charts for Datadog

This is noteworthy in that Datadog has steadily increased its number of outstanding shares in recent years, thereby diluting existing shareholders.

Current assessment of Datadog stocks

Until recently, Datadog was a real HGI top scorer. However, the company has lost this quality feature due to its latest quarterly figures and now only scores 10 out of a possible 18 points. This is due, on the one hand, to the relatively high valuation based on EV/sales and, on the other hand, to weak operating profitability and slowing growth. The overall HGI score is as follows.

Source: HGI-Score Datadog

However, it should be noted that the PEG ratio is only of limited significance due to Datadog's high P/E ratio. The company does not currently appear to be prioritizing profitability, as evidenced by the recent decline in earnings reported in its quarterly figures.

Datadog has significantly increased its free cash flow, the more important indicator for shareholders, which summarizes all financial resources flowing into the company from its operating activities, in recent years. Its free cash flow margin has also grown significantly over time, as the following chart shows:

Source: Datadog Charts

Although a free cash flow margin of over 30% is very impressive, the high level leaves little room for strong increases in the future. It can therefore be assumed that free cash flow growth will approximate revenue growth, provided that Datadog can maintain its margins despite intense competition.

Conclusion on Datadog

Datadog is a quality company with a leading role in a growing market. The company itself expects its target markets to grow by 11% to 20% annually in the coming years. And quality comes at a price: while Datadog was still grossly overpriced in 2020 with an EV/sales ratio of over 60, even today's valuation level is still high. An EV/sales ratio of just under 15 can only be justified if Datadog maintains its market leadership and also manages to maintain its high free cash flow margins. The EV/free cash flow ratio of around 40 is also historically favorable for the company, as the following chart shows. In absolute terms, however, it is still not cheap.

Source: EV / Free-Cashflow

If Datadog can maintain double-digit revenue growth over several years while maintaining a high free cash flow margin, the company has potential for further price gains. However, the stock price potential is currently limited, with a high risk of setbacks. This is also confirmed by analyst estimates, which give the company a “buy” rating, but see “only” 17% upside potential.

Source: Datadog analyst rating

For the time being, it is therefore worth setting up a buy alert for Datadog – for example, for an EV/sales ratio of 10. Or perhaps the stocks of its competitor Dynatrace are much more exciting anyway? Stay tuned 😉.

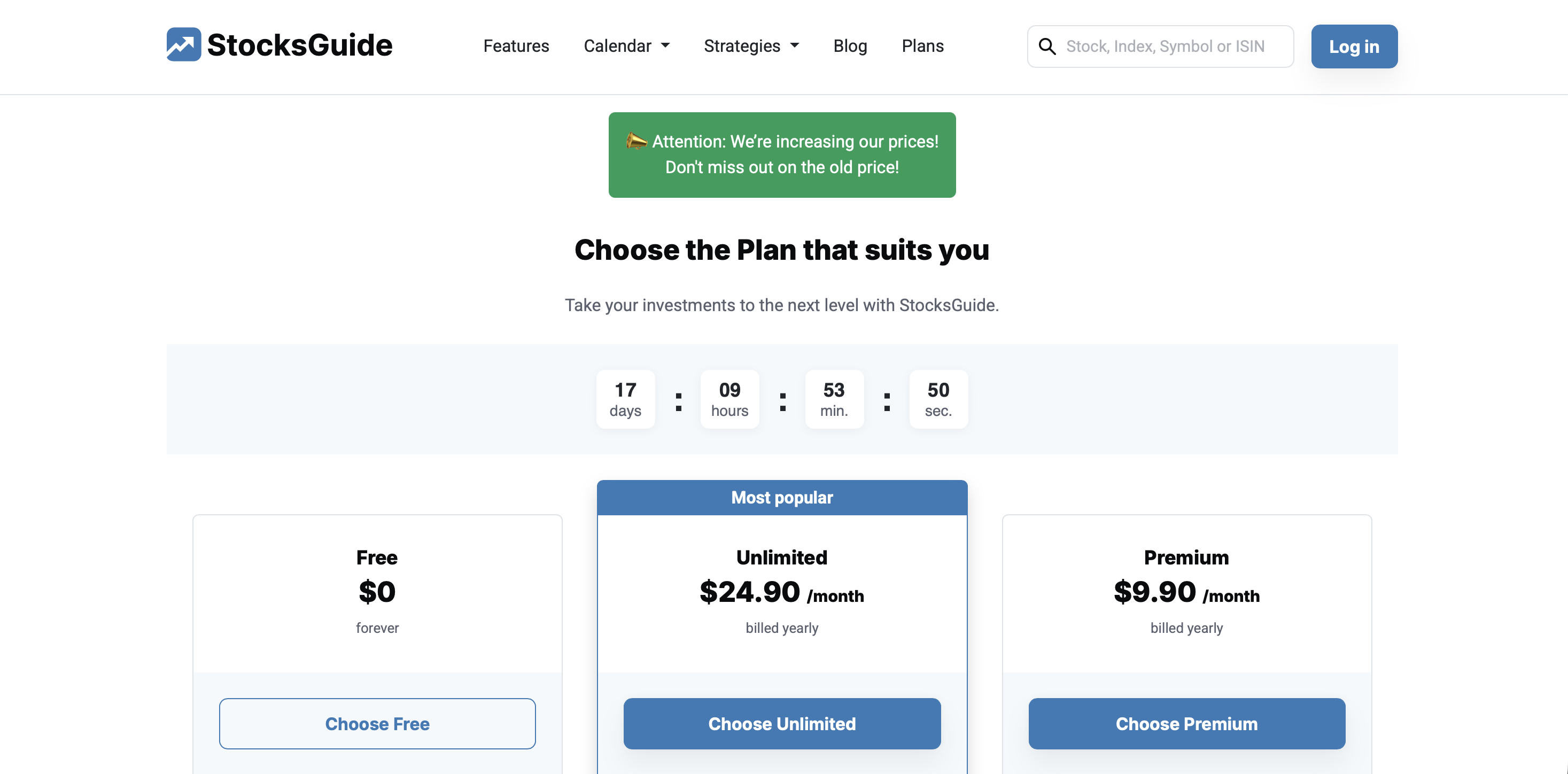

🔔 If you would like to receive new investment ideas and free stock analyses selected according to the Levermann, High-Growth Investing or Dividend strategies by email every week, you can now subscribe to our free StocksGuide newsletter.

The author and/or persons or companies associated with the StocksGuide own or may own stocks in Datadog.

This post represents an expression of opinion and not investment advice. Please note the legal information.