Table of contents

This blog post refers to the calculation of earnings growth according to the Levermann strategy. This uses the estimated net earnings per share. You can also calculate earnings growth for other earnings ratios (e.g. operating earnings/EBIT or EBITDA). In this context, you must therefore always pay close attention to which profit is the basis of the calculation.

What is profit growth?

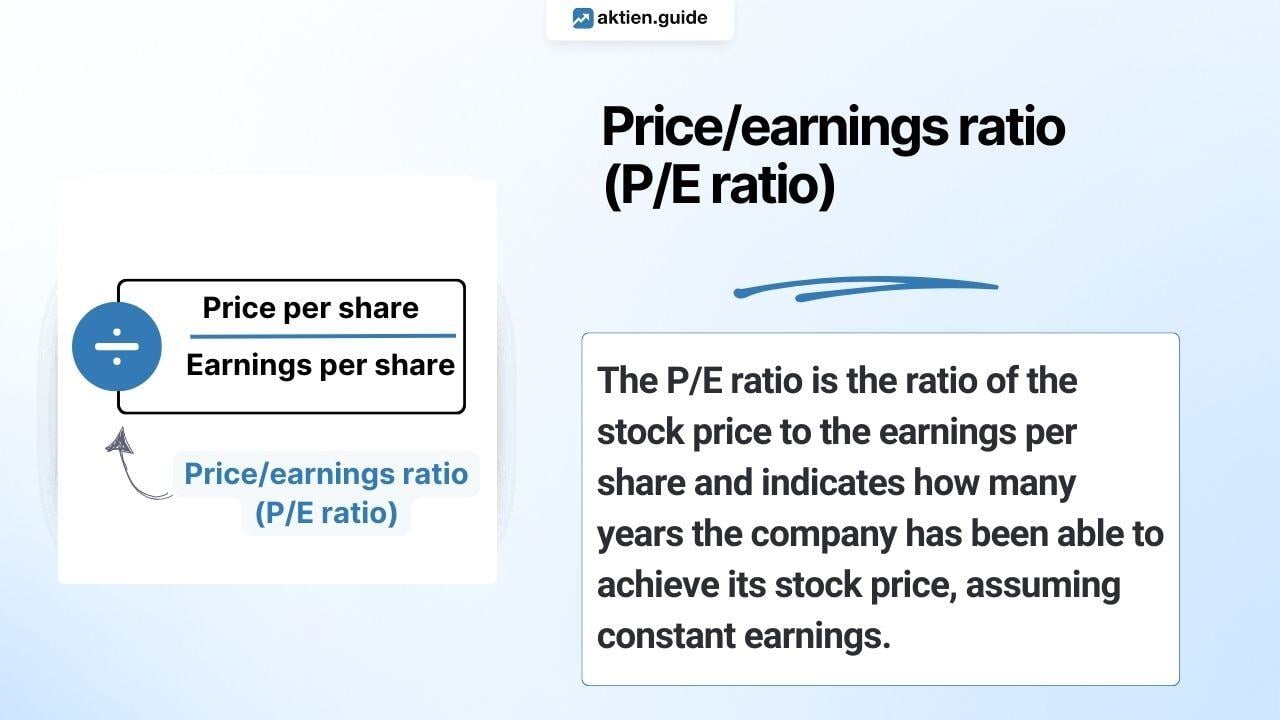

Earnings growth compares the estimated earnings per share (EPS) for the next financial year with the estimated earnings per share for the current financial year.

Earnings per share represent the proportion of a share in the company's net profit. The informative value of the key figure “earnings growth” increases if you include the historical development.

How is earnings growth calculated?

The estimated earnings per share (EPS) for the next financial year is divided by the estimated earnings per share for the current financial year.

Calculate earnings growth:

The calculation of SAP share earnings growth as of September 13, 2024 is shown as an illustration:

.jpg?width=624&height=139&name=Berechnung%20Gewinnwachstum%20(2).jpg)

According to the Levermann strategy, the following points are awarded for earnings growth:

The SAP share therefore receives 1 point, as the earnings growth of 25% is more than 5%.

What does earnings growth mean?

Earnings per share is one of many important key figures for evaluating companies. By taking earnings growth into account, it is possible to check whether the business model is still viable and will continue to grow in the future.

However, you should bear in mind that this is a comparison of average analyst estimates for a more or less uncertain future. These are often inaccurate, especially for smaller and younger companies.

In addition, the net profit used to calculate earnings growth is relatively easy to manipulate by management. Many experienced investors therefore prefer to look at the growth of the company's cash flow or operating profit instead.

In addition, there are many companies that do not yet generate any or only little net profit, but nevertheless already generate a positive cash flow. For these companies, it makes particular sense to look at the free cash flow or free cash flow margin.

In general, growth figures such as profit growth should always be viewed in historical terms. In this way, one-off effects can be identified and possible distortions become transparent. In the StocksGuide you can also view the historical earnings growth of a share in a chart.

Top 10 stocks with the highest earnings growth worldwide

The following table shows global mid and large cap stocks with the highest earnings growth and EBIT growth of more than 20 percent.

| Stock | EBIT growth |

| NVIDIA | 961.60% |

| Meituan Dianping | 854.34% |

| KKR & Co. Inc. | 802.20% |

| AMD (Advanced Micro Devices) | 703.11% |

| Palantir Technologies Inc | 543.58% |

| Palo Alto Networks | 370.98% |

| Progressive | 272.65% |

| Constellation Energy | 269.06% |

| Workday | 205.60% |

| AIA Group Limited | 205.55% |