Table of contents

- What is EBIT?

- How is EBIT calculated?

- What does EBIT mean?

- Top 10 shares with the highest EBIT worldwide

What is EBIT?

EBIT (Earnings Before Interest and Taxes) represents the operating result (profit or loss) of a company. In German, EBIT means earnings before interest and taxes.

Before we go into the calculation of the operating result or EBIT in more detail, it is important to distinguish EBIT from the key figure EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). EBITDA represents the operating result before depreciation and amortization.

The terms operating result or operating profit or loss and operating result can be used as synonyms for EBIT. In StocksGuide you will come across the operating result TTM, among others. TTM is the abbreviation for “Trailing Twelve Months” and indicates the operating result over the last 12 months or 4 quarters.

How is EBIT calculated?

EBIT or the operating result represents the profit or loss after deducting direct costs (cost of sales), sales, marketing, administration, research and development costs and depreciation and amortization.

Calculating EBIT:

The calculation of Facebook's EBIT (TTM) as at September 13, 2024 is shown as an illustration:

Revenue USD 149 billion

- Direct costs USD 27 billion

= Gross profit USD 122 billion

- Operating expenses USD 48 billion

= EBITDA USD 73 billion

- Depreciation and amortization USD 13 billion

= EBIT (operating result) 60 billion USD

*z. e.g. sales, marketing, administration, research and development costs, other operating income and expenses

In StocksGuide you will find the income statement for each share in the “Overview” tab under Financial data. The calculation of EBIT is also shown there (with a focus on the most important items):

What does EBIT mean?

EBIT is a key figure that enables companies to be compared with each other as well as possible, irrespective of the respective national tax burden and financing structure. This is why the operating result is a frequently used key figure internationally. As an investor, you can use EBIT to quickly find out whether the company is making a profit or not.

If you take a closer look at the calculation, you can make statements about the efficiency of administration or sales, for example, as well as the level of research and development costs.

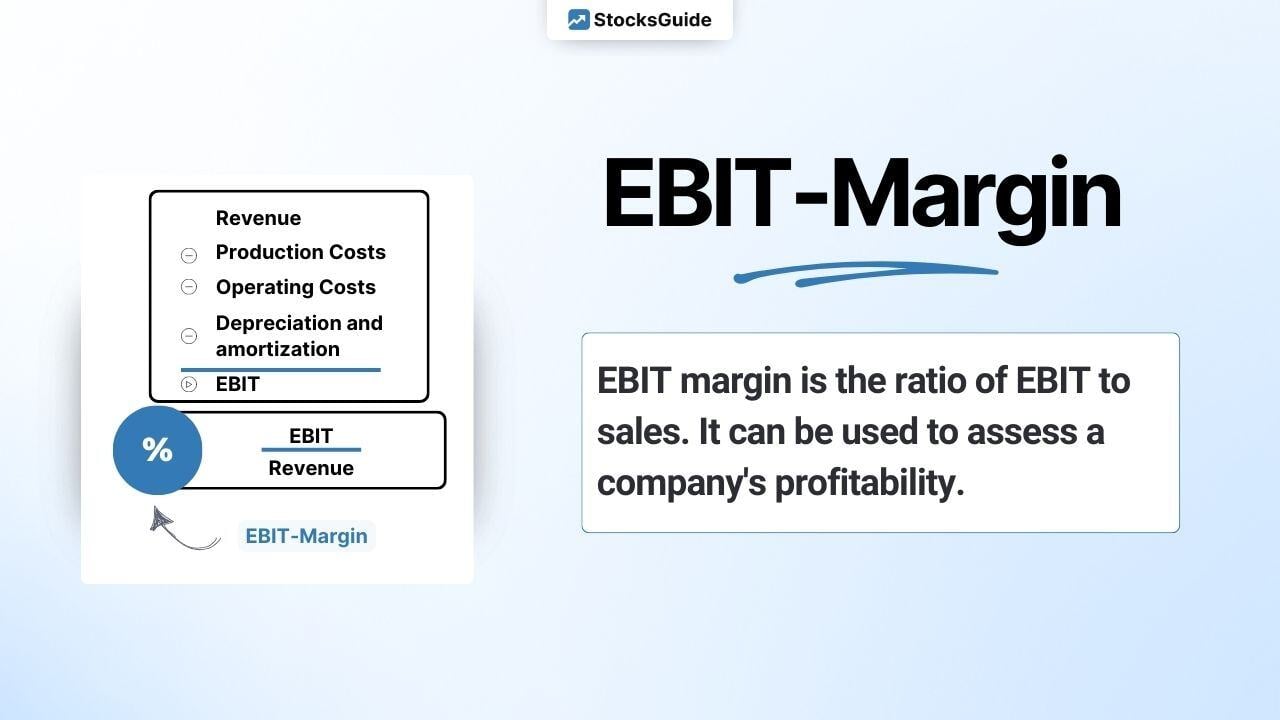

In addition to the pure consideration of the absolute operating profit, the EBIT margin plays an important role. The EBIT margin puts EBIT in relation to sales and is an important indicator for determining the profitability of a company.

You can also see the EBIT margin directly in StocksGuide (red box):

Whether the EBIT under consideration is good or bad also depends on other influencing factors, e.g:

- long-term development of EBIT

- EBIT margin

- EBIT and EBIT margin compared to the competition

- Future prospects of a company's industry

- Position of the company in this market

- Speed of growth

- Business model

Top 10 stocks with the highest EBIT worldwide

The following table shows the top 10 stock with the highest EBIT (TTM) worldwide. Only financial stocks are not included.

| Stock | EBIT TTM |

| Saudi Aramco | $224.53b |

| Apple | $120.59b |

| Microsoft | $109.43b |

| PetroChina Company | $106.74b |

| Alphabet | $99.08b |

| JPMorgan Chase & Co. | $69.58b |

| Meta Platforms (Facebook) | $60.65b |

| Industrial and Commercial Bank of China | $57.80b |

| China Construction Bank Corporation | $55.13b |

| Amazon.com | $55.10b |

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)