Table of contents

What is EPS (TTM)?

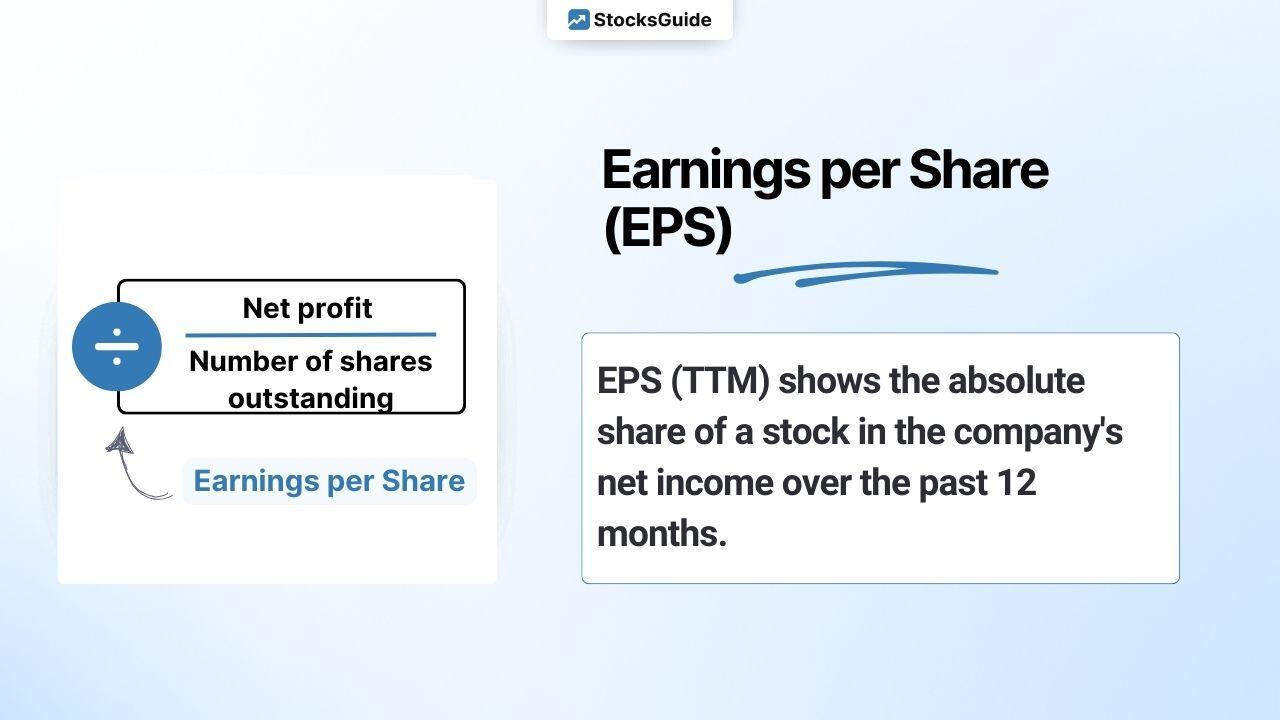

EPS (TTM) is the absolute share of a company's net profit for the last 12 months. Earnings per share are referred to as EPS. EPS is the abbreviation for “Earnings per Share” and TTM is the abbreviation for “Trailing Twelve Months”.

EPS and earnings per share can therefore be used as synonyms. By considering the last 12 months, the most recent figures from the last 4 quarterly reports are always taken into account.

Diluted earnings per share or diluted EPS

Some companies report diluted earnings per share (diluted EPS). This figure is usually shown directly below earnings per share. In most cases, diluted earnings per share result from an increase in the number of shares in the reporting period. This can occur, for example, through share options, share buybacks, share splits or capital increases.

An increase in the number of shares issued distorts or dilutes the actual earnings per share, as the profit must be distributed over more shares. For this reason, the key figure is issued explicitly. EPS and diluted EPS are often the same, but not always.

How is EPS (TTM) calculated?

The company's net profit over the last 12 months is divided by the number of shares outstanding.

Calculate EPS (TTM):

The calculation of EPS (TTM) or earnings per share (TTM) of Amazon shares as of September 13, 2024 is shown as an illustration:

What does EPS (TTM) mean?

Earnings per share (TTM) or EPS (TTM) is the profit after tax to which each individual share is arithmetically entitled. This key figure can be used to describe the earning power of a company.

Important: In general, high earnings per share are considered very good. However, the absolute value of earnings per share says little about whether a company has a solid business model and is healthy.

How do corporate actions affect EPS?

Share buyback

A company buys back shares. This reduces the number of shares issued and EPS (TTM) increases

Share split 1:2

Shareholders receive an additional share for each share and the share price is halved. The number of shares doubles, each shareholder holds double the number of shares. EPS (TTM) halves (but each shareholder is entitled to the same share of the profit)

Capital increase

The company issues new shares on the capital market. This increases the number of shares issued.EPS (TTM) falls.

In addition to the capital measures, it is very important…

- to look at earnings per share over a period of several years.

- consider the development of the number of shares issued.

- compare the development and level with direct competitors.

- analyze EPS growth and, if necessary, take a look at diluted earnings per share.

Table of companies with the highest Net Income (TTM) in the S&P 500

| Stock | Net Income |

| Apple | $101.96b |

| Microsoft | $88.14b |

| Alphabet | $87.66b |

| Berkshire Hathaway | $67.86b |

| JPMorgan Chase & Co. | $53.70b |

| Meta Platforms (Facebook) | $51.43b |

| Amazon.com | $44.42b |

| NVIDIA | $42.60b |

| ExxonMobil | $34.16b |

| Bank of America | $24.52b |

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)