Free cash flow per share is one of the most important key figures for investors to assess the financial strength and growth potential of a company. This article is designed to give you a comprehensive understanding of this ratio so that you can use it effectively in your own analysis. In this article, we will explain the definition, calculation, interpretation and application of free cash flow per share.

Table of contents

- Free cash flow per share: What does it mean?

- Importance of the key figure for investors

- Calculating free cash flow per share (step-by-step guide with formula)

- Practical examples: Free cash flow per share in the real world

- 3 reasons why you should use free cash flow per share instead of earnings per share

- Conclusion & free cash flow per share interpretation

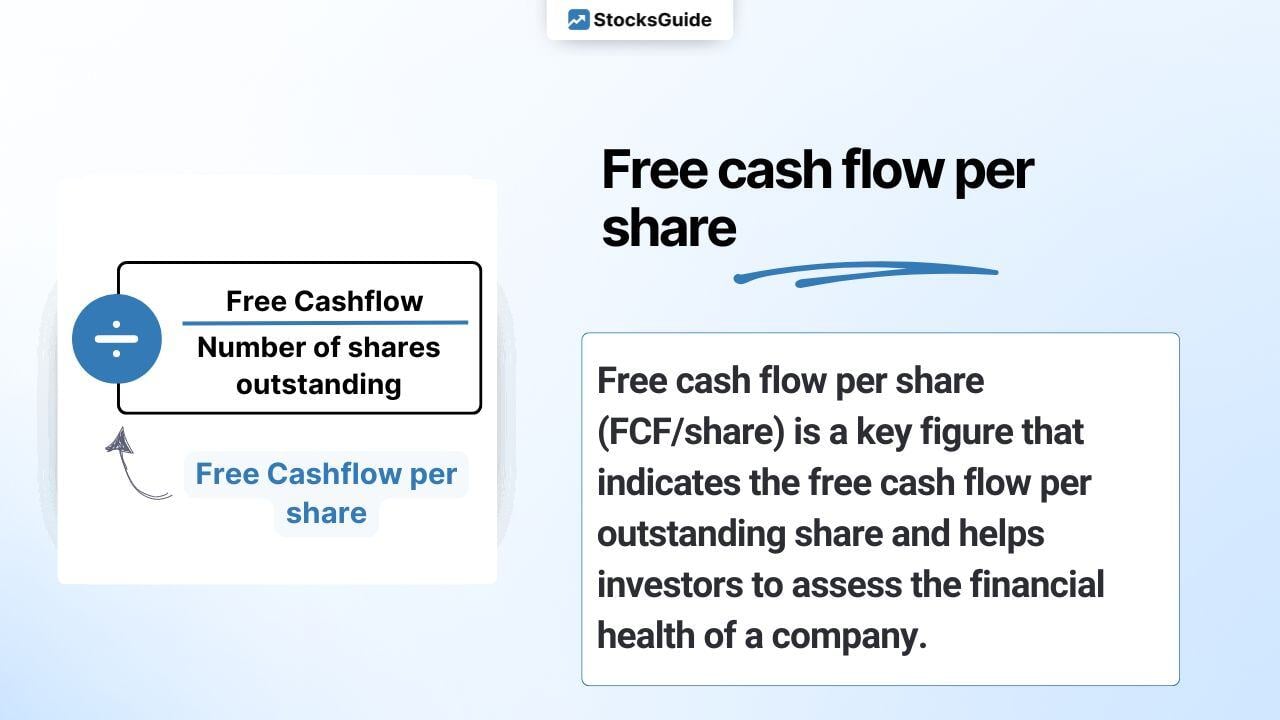

Free cash flow per share: What does it mean?

Free cash flow per share (FCF/share) is a key figure that indicates the free cash flow per outstanding share. This figure is calculated by dividing a company's free cash flow by the number of shares issued. FCF/share gives investors an insight into a company's profitability and ability to create value for shareholders. Here you can find an article that explains free cash flow in simple terms: Read now

Importance of the key figure for investors

Free cash flow per share is an important metric for investors as it helps them assess the financial health and growth potential of a company. A high FCF per share indicates that a company has sufficient cash to meet its obligations and invest in future growth.

Calculating free cash flow per share (step-by-step guide with formula)

To calculate the free cash flow per share, proceed as follows:

- Determine the company's free cash flow.

- Divide the free cash flow by the number of shares outstanding.

Let's assume that company X has a free cash flow of 10 million euros and a total of 1 million outstanding shares. To calculate the free cash flow per share, divide 10 million euros by 1 million:

Free cash flow per share = €10,000,000 / 1,000,000 shares = €10 per share

In this example, each shareholder of company X would theoretically be entitled to an amount of EUR 10 if the entire free cash flow were distributed. Compared to other companies in the sector, you can use this to assess whether company X is doing well and is attractive to you as an investor.

But don't worry, you don't have to laboriously calculate the ratio yourself every time: With the Fundamental Charts in StocksGuide, you can directly display the free cash flow per share and thus easily compare the GAFAM companies (Google, Amazon, Facebook, Apple, Microsoft), for example:

-png.png?width=1089&height=671&name=Bildschirmfoto%202025-05-20%20um%2017-06-29%20(2)-png.png)

Source: Free Cashflow comparison

Practical examples: Free cash flow per share in the real world

Example 1: Successful company Microsoft

As the industry leader,Microsoft generates a free cash flow per share of 9 dollars. This figure shows that the company is very successful and generates surplus capital that can potentially be used for dividend payments or share buybacks.

-png.png?width=1092&height=712&name=Bildschirmfoto%202025-05-20%20um%2017-05-39%20(2)-png.png)

Source: Microsoft Free Cashflow Per Share

Example 2: Company with growth potential CrowdStrike

CrowdStrike, a young company in an up-and-coming sector, has a free cash flow per share of around 4 dollars, which has doubled in the last two years. This company could be interesting for you as an investor, as the free cash flow per share is currently rising sharply.

-png.png?width=1105&height=718&name=Bildschirmfoto%202025-05-20%20um%2017-04-33%20(2)-png.png)

Source: CrowdStrike Holdings Free cashflow Per Share

Example 3: Company in difficulty Beyond Meat

BeyondMeat has a free cash flow per share of -1 dollars. This negative value indicates financial difficulties. The company is currently unable to finance itself and could be risky for investors.

-png.png?width=1092&height=713&name=Bildschirmfoto%202025-05-20%20um%2017-07-32%20(2)-png.png)

Source: Beyond Meat Free cashflow Per Share

Comparison of results and analysis

By comparing the free cash flow per share of different companies, you can gain valuable information about their financial situation. This helps you to better assess potential investment opportunities and make informed decisions.

-png.png?width=1115&height=669&name=Bildschirmfoto%202025-05-20%20um%2017-14-41%20(2)-png.png)

Source: Free Cash Flow Per Share Comparison

The picture above clearly shows the three different financial situations in which these companies find themselves. Microsoft is generating 9 dollars per share and Beyond Meat is clearly in negative territory.

3 reasons why you should use free cash flow per share instead of earnings per share

Free cash flow per share is often more meaningful than earnings per share when it comes to assessing the financial strength of a company. Here are three reasons why you should use free cash flow per share instead:

1. More realistic representation of liquidity:

Free cash flow per share shows how much money is actually available to pay dividends, pay down debt, buy back shares or invest in the company's growth. In contrast, earnings per share can be distorted by balance sheet depreciation, non-cash expenses and tax effects, making it a less realistic picture of the financial situation.

2. resistance to balance sheet manipulation:

Free cash flow per share is less susceptible to accounting manipulation because it is based on actual cash flows and is not influenced by accounting practices. Earnings per share, on the other hand, can be influenced by creative accounting and various depreciation and amortization practices.

3. emphasis on capital allocation:

By looking at free cash flow per share, you can better assess how efficiently a company's management is allocating capital. A high free cash flow per share shows you that the company is generating excess capital and is able to deploy it effectively.

It is important to note that no single ratio can provide a complete picture of a company. Therefore, free cash flow per share is best used in combination with other metrics to provide a comprehensive analysis of a company's financial strength and profitability.

Conclusion & free cash flow per share interpretation

Free cash flow per share is an important financial ratio that helps you to assess the financial performance and efficiency of a company. Compared to other common ratios such as earnings per share (EPS), price-earnings ratio or return on equity, free cash flow per share provides a deeper insight into a company's liquidity and its ability to generate surpluses and use them for dividends, debt reduction or investments.

Although free cash flow per share is a very valuable metric, you should not look at it in isolation. To get a comprehensive picture of a company's financial situation, it is advisable to analyze free cash flow per share in combination with other key figures. This allows you to better identify potential risks and opportunities and make informed decisions.

Overall, free cash flow per share is a very useful indicator that belongs in every investor's toolbox in order to be able to comprehensively assess the financial stability, profitability and growth potential of a company.

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)