Table of Contents

What is Gross Margin?

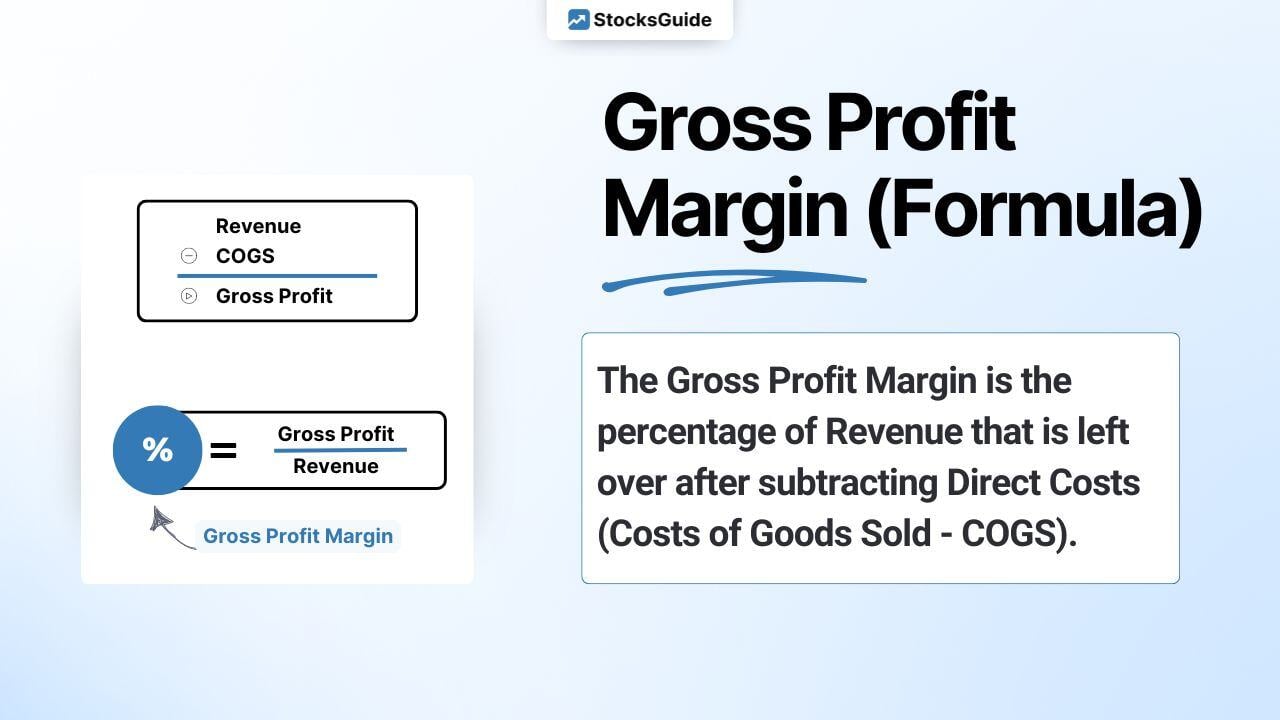

Gross Margin is the percentage of revenue remaining after subtracting the direct costs of production. Also known as gross profit margin, it provides an initial impression of a company's potential profitability, even if the company is not yet profitable overall. Software companies typically have higher gross margins due to lower production costs.

Gross Margin = Gross Profit / Revenue

Higher gross margins indicate more profitable operations.

The comparison of the car manufacturer Tesla, the home improvment store Home Depot and the software giant Microsoft illustrates how different the gross margin can be:

How is Gross Margin Calculated?

Gross Margin is calculated by subtracting direct costs (COGS) from revenue and then dividing by revenue.

Gross Margin = (Revenue−Direct Costs) / Revenue

Example Calculation (Okta):

The following chart shows the development of the gross margin of Zscaler, Qualys and Okta shares:

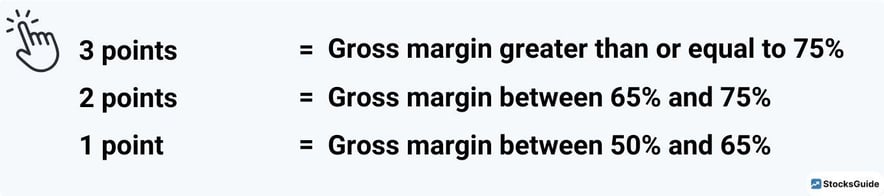

Scoring in High-Growth-Investing Strategy:

Okta receives 3 points with a Gross Margin of 76%.

Note: You should monitor the development of the gross margin. Rising gross margins are positive.

What Does Gross Margin Indicate?

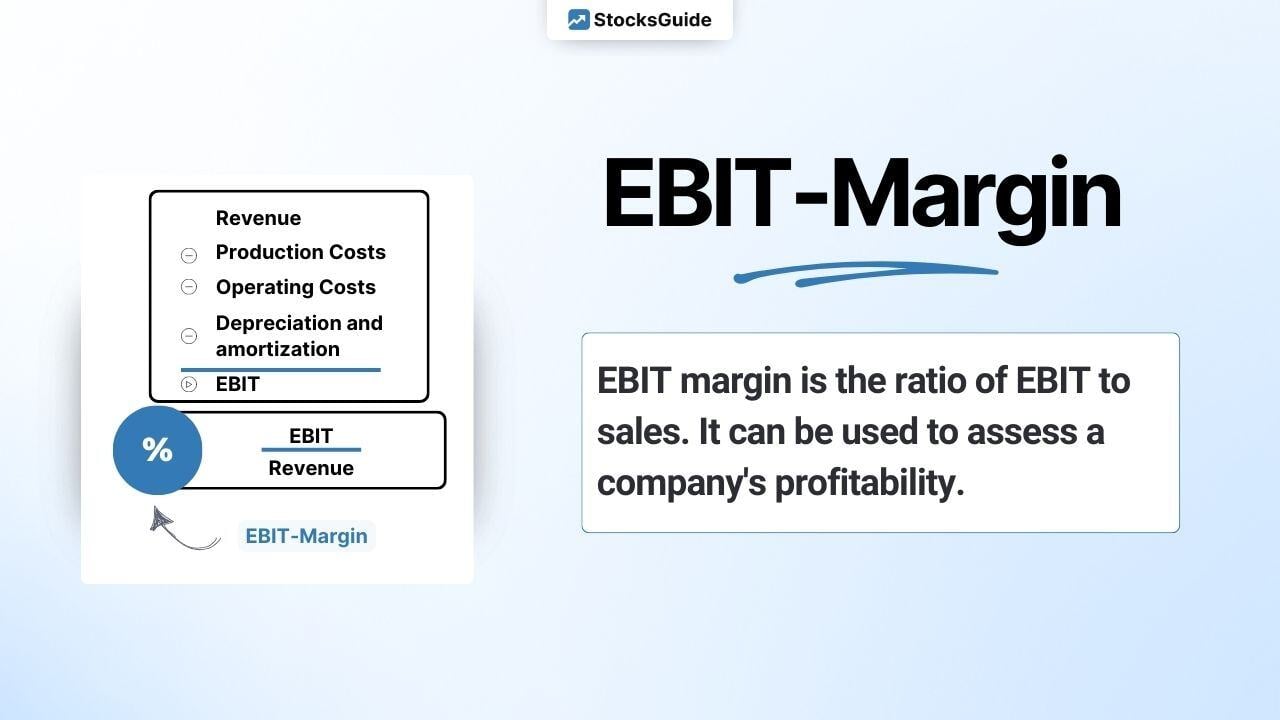

Gross Margin indicates the percentage of revenue remaining after direct production costs, reflecting a company's cost efficiency and profitability. Higher gross margins mean more capital for other areas like marketing, sales, and R&D. It appears before EBITDA, EBIT, and net profit in the income statement.

Monitoring Gross Margin: Consistently rising or stable gross margins are positive indicators. Falling gross margins suggest increasing costs outpacing revenue, limiting funds for crucial areas.

What is a Good Gross Margin?

The definition of a good gross margin varies by industry. For example, automakers typically have margins below 25%, while top software companies can exceed 80%. Business models and revenue mix within the same industry can result in different gross margins. Hardware sales and services often have lower margins compared to software subscriptions.