Table of contents

- What is the return on equity?

- How is the return on equity calculated?

- What does return on equity mean?

What is return on equity?

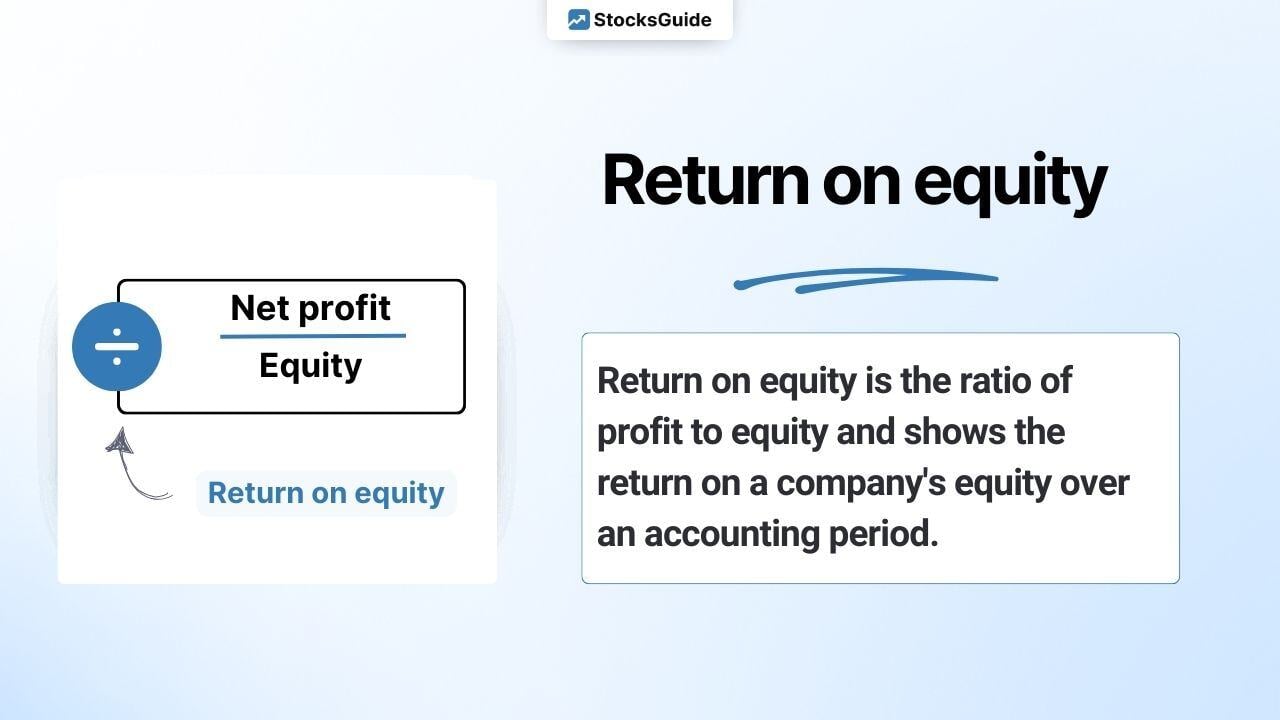

The return on equity (RoE) or return on equity describes the ratio of profit to equity.

In contrast to debt capital, equity is all the financial resources raised by the shareholders to finance the company, e.g. as part of the foundation or a capital increase. The profit generated, which is retained by the company and not distributed to shareholders, is also part of equity.

The return on equity is a profitability indicator and shows the return on a company's equity within an accounting period.

A shareholder can use the return on equity to recognize how profitable his investment in the company is.

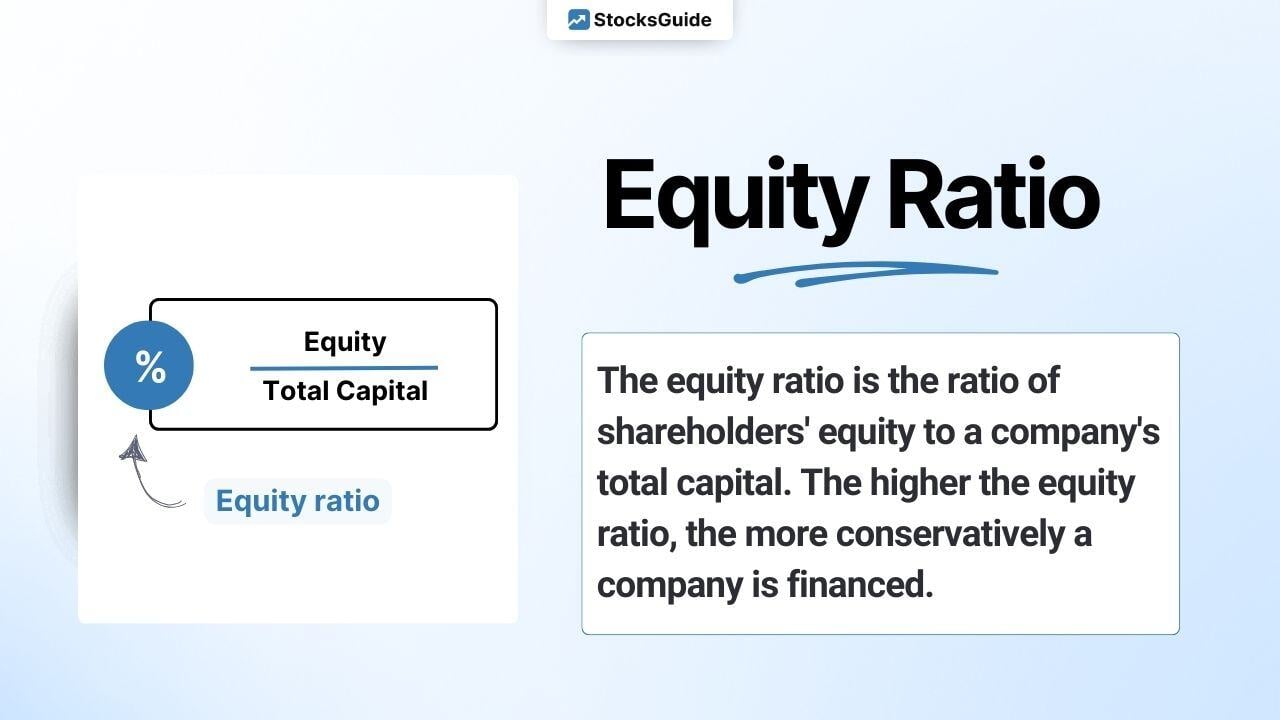

The return on equity should always be viewed in conjunction with the equity ratio in order to exclude companies with high levels of debt.

How is the return on equity calculated?

The profit is divided by the equity and multiplied by 100. According to the Levermann strategy, the corresponding figures for the last completed financial year are used for the calculation.

Calculate return on equity:

The calculation of the return on equity of the SAP share as of September 13, 2024 is shown as an illustration:

According to the Levermann strategy, the following points are awarded for return on equity:

What does the return on equity mean?

The return on equity belongs to the category of profitability ratios. This key figure is therefore well suited to comparing different investments with one another.

In general, the higher the return on equity, the better. A low return on equity, on the other hand, indicates inefficient use of capital or an overvaluation of assets on the balance sheet.

Important: The return on equity should always be considered in conjunction with the equity ratio, as the return on equity alone is not very meaningful.

Top 10 stocks with an attractive return on equity

The following table shows mid and large cap stocks with a high return on equity, an equity ratio of at least 25% and a debt/equity ratio of 0 to 1.

| Stock | Return on Equity | Equity Ratio |

| Rightmove | 287.14% | 66.13% |

| Banco Macro SA Sponsored ADR Class B | 78.88% | 30.43% |

| Novo Nordisk | 78.53% | 33.88% |

| Spectrum Brands Holdings, Inc. | 71.63% | 47.89% |

| Pilbara Minerals | 70.53% | 65.21% |

| NVIDIA | 69.24% | 65.39% |

| Roivant Sciences | 67.44% | 89.28% |

| Manhattan Associates | 63.45% | 41.33% |

| CommVault Systems, Inc. | 60.74% | 29.46% |

| Gaztransport et technigaz SA | 59.87% | 54.57% |