Table of Contents

The ongoing boom in online retail is driving not only e-commerce itself but also the entire logistics industry to new records. One of the biggest winners of this development is DHL Group (ISIN: DE0005552004), which has become a leading global logistics and shipping giant. Its stock price has also risen steadily by almost 100 percent over the last two decades. When the high annual dividends are taken into account, the total return is almost twice as high.

Source: DHL Group stock price

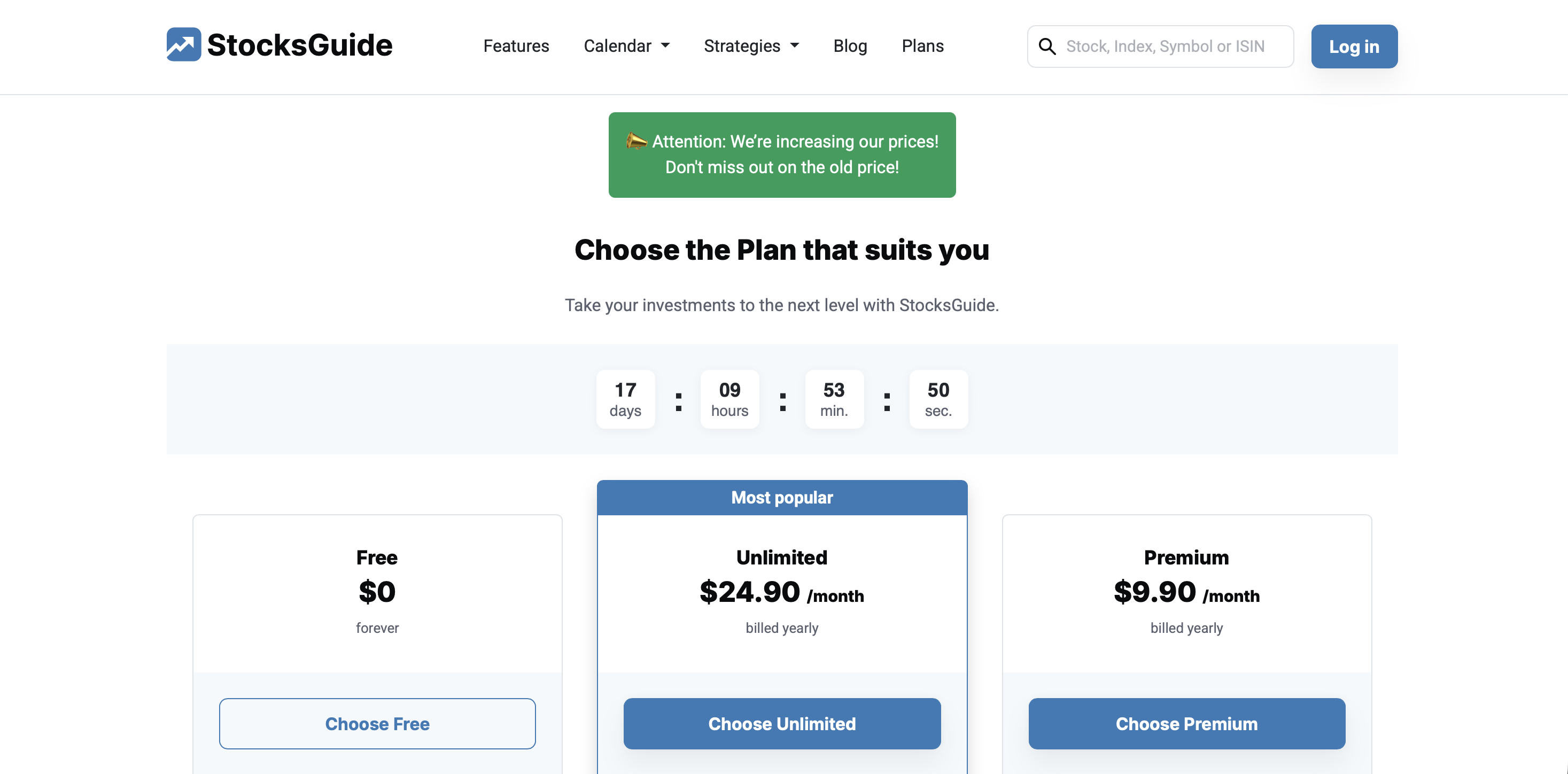

With an impressive twelve points in the current dividend scoring by StocksGuide, DHL Group stock is among Germany's top dividend stocks. The stock also currently scores highly in the Levermann analysis. In the following DHL Group stock analysis, we examine whether DHL Group stock can also impress in the long term, aside from their dividend qualities.

💡 In a nutshell

- DHL Group is a leading global logistics provider and remains profitable and well positioned for long-term growth even in a volatile environment.

- With a dividend yield of around 4.7 percent and a favorable valuation, the stock is one of the most attractive dividend stocks in the DAX.

- However, key metrics are missing for the stock to gain momentum.

Company profile DHL Group – leading global logistics provider

Alongside UPS and FedEx, the DHL Group is one of the world's leading logistics providers. More than 600,000 employees now work for the Bonn-based group around the world, which has transformed its former national letter monopoly into a competitive business model with a bright future. Strong online retail in particular has laid the foundation for this positive development. The company offers a wide range of services along the entire supply chain – from letter and parcel delivery, express delivery, and freight transport to contract logistics and supply chain management. The year 2025 shows that the DHL Group is stable even in a volatile economic environment. Continued demand in online retail continues to provide support, enabling the company to benefit from structural demand. DHL Group is not only an important link in the supply chain – in many ways, it represents the supply chain itself.

These figures show just how large the group is: in fiscal year 2024, DHL Group generated total revenue of €84.2 billion. Compared to the previous year's figure of €81.8 billion, this represents growth of just under 3 percent. Operating profit reached €5.9 billion. The corresponding EBIT margin was 7.0 percent. Let's take a look at the latest quarterly figures.

The latest DHL Group quarterly figures from June 2025

DHL Group closed the second quarter of 2025 with solid earnings growth despite a challenging global environment. Despite a slight decline in revenue due to exchange rate effects and weaker trade volumes, the Group improved its profitability and further expanded its operating margin. In concrete figures, revenue fell by 4 percent to €19.8 billion, while net profit rose by 10 percent to €815 million.

Source: DHL Group financial data

While geopolitical tensions and trade conflicts weighed on the momentum of the global economy, DHL Group benefited from its broad positioning across various business areas and regions. The focus on efficiency improvements and disciplined cost control ultimately contributed significantly to the increase in operating profit. The Group-wide “Fit for Growth” program is increasingly showing its effects: capacities were specifically adjusted to demand, structural costs were reduced, and processes were further optimized, particularly in the express and supply chain businesses.

Strategically, DHL Group is continuing to invest in growth markets and future-oriented segments. Particularly noteworthy are new projects in the Middle East, where more than €500 million is to be invested between 2024 and 2030, and the strengthening of the pharmaceutical logistics business through the acquisition of CRYOPDP. In the e-commerce sector, DHL is also expanding its presence in a structurally growing market with acquisitions such as IDS Fulfillment in the US and a partnership with Evri in the UK.

DHL Group stock forecast for 2025

Despite ongoing uncertainties in the global economic environment, DHL Group is looking ahead to the rest of the year with a certain degree of confidence. Management expects the macroeconomic environment to remain subdued in the coming quarters, characterized by fluctuating trade volumes and geopolitical tensions. Nevertheless, thanks to its broad positioning and consistent efficiency programs, the Group considers itself well equipped to achieve stable results. The cost-cutting and structural measures that have been introduced are expected to have an increasing impact over the course of the year and make a positive contribution to earnings development. Based on these assumptions, DHL Group is sticking to its previous forecast: For fiscal year 2025, management expects operating profit (EBIT) of at least €6 billion and free cash flow of around €3 billion (excluding M&A effects in both cases). This unchanged forecast once again underscores the company's confidence in its own operational strength – even in an environment characterized by uncertainties in customs and trade policy and an economic slowdown. However, further geopolitical or trade policy escalations could have a noticeable impact on the transport and logistics business.

Source: Sales and Margin forecast

A look at analysts' estimates shows that DHL Group should continue to grow in the short and medium term thanks to structural trends. Although sales are only expected to increase in the low single-digit range per year, efficiency gains could make double-digit earnings growth realistic. Dividend investors in particular could benefit from this development, as the following chapter shows.

Key figures for DHL Group stock from the dividend analysis

In terms of dividend payments, DHL Group has been one of the most reliable dividend payers in the DAX 40 for years – and this is also reflected in its current dividend score of 13 out of 15 points.

Source: Dividend analysis

The key figures show not only solid earnings, but above all a consistently implemented dividend strategy that combines stability and growth. With a current dividend yield of 4.8 percent, the stock currently offers an attractive current yield that is well above the market average. It is interesting to note that this yield is not the result of a special situation – such as falling prices or exceptionally high distributions – but rather of sustainably grown profit levels. A look back also reveals the strength of the business model: over the last ten years, the average dividend yield has been 3.9 percent, clearly positioning the DHL Group as a reliable dividend stock. The payout ratio of around 55 percent over the past three years also shows that the high dividends are not at the expense of distributions from assets. Management deliberately focuses on balance. On the one hand, shareholders receive a generous share of the profits, while on the other hand, enough capital remains in the company to finance future investments, acquisitions, or market changes. It is precisely this conservative dividend policy that gives the DHL Group flexibility—an important advantage in a cyclical industry that is heavily dependent on global trade and economic cycles. Another quality feature is the continuity of dividend payments. Over the past ten years, the distribution has never been reduced, but has been regularly increased or at least kept stable. This is not a matter of course in an environment characterized by structural changes in logistics and volatile energy prices. This stability is testament to the predictability of cash flows and management's confidence in its own earning power.

Source: Dividend history & estimates

With an average increase of around 10 percent per year over five years, the stock has shown impressive dividend growth. This shows that earnings are not only stable but also steadily increasing. Even though growth is likely to be somewhat more moderate in the future due to a more mature business or cyclical factors, this development signals that DHL Group is creating long-term value for its shareholders.

Source: DHL Group analysis

With 6 out of a possible 13 points, the Levermann analysis also shows that the stock is a buy. The high equity ratio of 34 percent, the low P/E ratio, and the price momentum over six months are particularly important points in the analysis. Analyst opinions, earnings revisions, and the reaction to the quarterly figures support the score. Earnings growth of 10.2 percent and the price increase compared to six months ago also have a positive effect.

Valuation of DHL Group stock

With a current price-earnings ratio of around 13 and an expected value of 12.9 for the coming year, DHL Group stock is moderately valued. The dividend yield of 4.7 percent remains particularly attractive, as it is above average in the current market environment. Combined with a stable distribution policy and a moderate payout ratio, the stock offers investors a convincing earnings profile with long-term predictability – an aspect that makes them particularly interesting for income-oriented investors. The valuation also appears solid from a cash flow perspective: the ratio of enterprise value to free cash flow (EV/FCF) is 10.9, which indicates a fair, slightly below-average valuation compared to other international logistics companies. However, the market could also be pricing in some risks. The DHL Group is currently facing several structural and operational challenges. Continued weakness in global trade and geopolitical tensions are weighing on the transport and freight business. Exchange rate effects and lower trade volumes are having a negative impact on revenue, while rising costs for personnel, energy, and logistics are putting pressure on margins. In Germany, the Group is struggling with declining volumes, increasing cost and competitive pressure, and ongoing labor disputes, particularly in the mail and parcel business. The announced reduction of around 8,000 jobs shows how consistently management is trying to adapt the cost base to the new market environment – but the process also carries risks for service quality and employee satisfaction. Added to this are regulatory uncertainties and trade tensions, which are affecting international logistics flows and making planning more difficult. The number of customer complaints about delivery quality and delays has also risen significantly in Germany recently, indicating operational bottlenecks and structural adjustment pressure. Analysts' outlook for revenue growth remains subdued at around 1 percent for the current year, reflecting the cyclical nature of the business. Nevertheless, the company benefits from its broad geographical diversification and strategic focus on higher-margin segments such as express and pharmaceutical logistics, which are expected to grow above the group average in the medium term.

Conclusion on DHL Group stock

Despite a difficult macroeconomic environment, DHL Group presents itself as a robust and reliably managed group. In recent quarters, the company has shown that it can increase its profitability even under adverse conditions. This is attributable to consistent cost management, a broad positioning, and a clear strategic focus on high-margin growth areas such as express and pharmaceutical logistics.

With a dividend yield of around 4.8 percent and a stable distribution policy that has remained unchanged for years, the stock remains attractive, especially for income-oriented investors. The Levermann analysis also shows positive momentum. The moderate valuation with a P/E ratio of around 13 and an EV/FCF of around 11 also indicates that the market currently considers the stock to be fairly valued, possibly slightly undervalued, in the European logistics sector. In the short term, however, structural challenges are weighing on the stock price, in particular rising costs, the decline in letter mail business, and high dependence on global trade volumes. However, the long-term outlook remains intact. Here, the DHL Group is benefiting from global megatrends such as e-commerce, digitalization, and the growing demand for specialized logistics, particularly in the healthcare and pharmaceutical sectors.

Source: DHL Group target price

Analysts also view the stock predominantly positively: 50 percent of them—and thus the majority—recommend buying, 38 percent recommend holding, and only 12 percent recommend selling. The average price target is 14 percent over one year, which is clearly in the double-digit range. In view of the potential risks, the market is pricing in a solid risk buffer here. From a tactical point of view, I therefore do not believe that the stock is currently a good entry point. Sentiment needs to change considerably before the stock can realize its price potential. Those looking for better timing could set the €35 mark as an alert level to take another look at the stock.

🔔 If you would like to receive weekly investment ideas and free stock analyses selected according to the Levermann, high-growth investing, or dividend strategies by email, you can subscribe to our free StocksGuide Insider now.

The author and/or persons or companies associated with StocksGuide own or may own shares of Munich Re. This article represents an expression of opinion and does not constitute investment advice. Please note the legal information.