Table of Contents

The global wealth management market is growing steadily and is considered attractive. However, there are also challenges such as consolidation pressure due to low-cost ETFs. Against this backdrop, specialized private banks such as the Julius Bär Group (ISIN: CH0102484968) are becoming more important as they can meet the requirements of discerning clients with tailor-made solutions. With over 130 years of experience, it has established itself over many years as a leading global asset manager serving high- and ultra-high-net-worth individuals, combining traditional values such as discretion and personal service with innovation, digitalization, and international expansion. The Swiss private bank currently manages CHF 483 billion, which is a large sum.

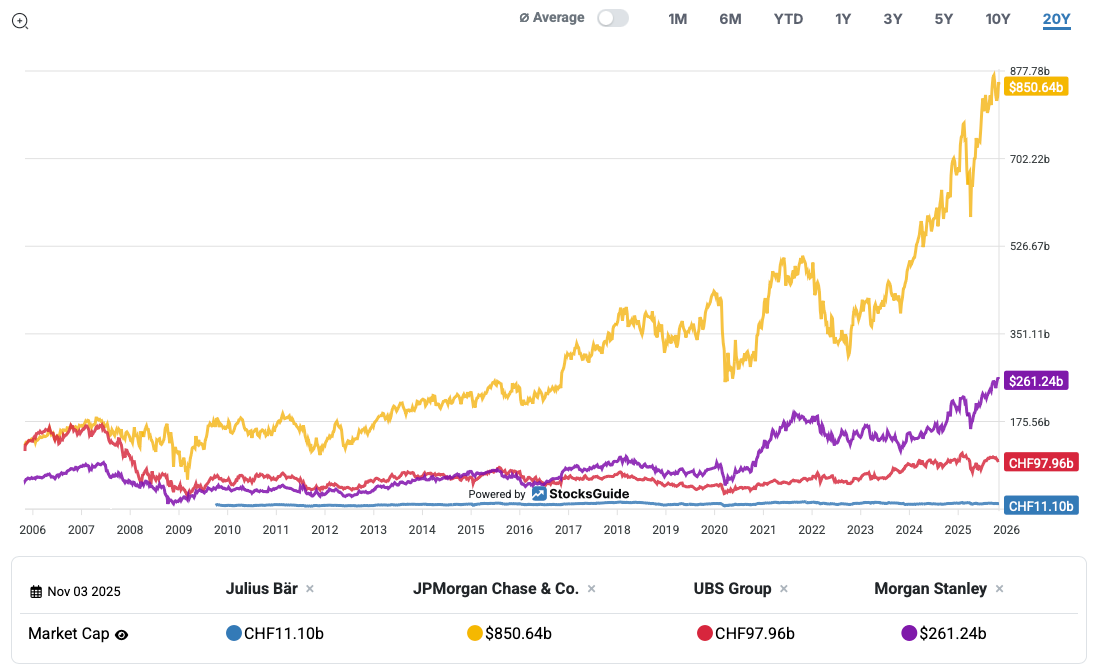

However, compared to the world's largest asset managers, Julius Bär is only a relatively small player. In addition, competition from fintech companies is increasing. This can also be seen in the stock price, which has only risen by around 44 percent over the past 15 years.

Source: Julius Bär stock price

However, there is more that shareholders can benefit from, such as high annual dividends. The stock has been performing well in dividend analysis for years, and the current fundamentals are not looking bad either. Attractive growth is even possible in the medium term. Despite the challenges of the environment, the question arises as to whether the stock is worth buying. Our latest Julius Bär stock analysis reveals the answer.

💡 In a nutshell

- Julius Bär is a specialized Swiss asset manager with CHF 483 billion in assets under management.

- High inflows of new money and a solid operating business recently speak in favor of the stock.

- The stock is attractively valued and offers high dividends, but is subject to cycles and consolidation risks.

Company profile – leading Swiss wealth management group

Julius Bär is a traditional Swiss private bank based in Zurich that specializes exclusively in wealth management for affluent private clients. It most recently had assets under management of around CHF 483 billion. However, its business model differs significantly from that of a universal bank. The bank does not focus on lending or deposit business, but rather on personal advice, management, and long-term development of client assets. Its main clients include wealthy private individuals, known as high net worth individuals (HNWIs). However, very wealthy private individuals, known as ultra high net worth individuals (UHNWIs), are also part of its core target group. They are offered a wide range of services, including investment advice, discretionary asset management, structured products, alternative investments such as hedge funds or private equity, and real estate financing. In addition, the bank is increasingly involved in digital assets and invests in modern technologies in order to offer innovative investment solutions.

Sources of revenue

Revenues are derived primarily from fees and commissions charged for managing and advising on client assets. An important factor for success is the generation of recurring, high-margin income – for example, through discretionary mandates. In this context, the bank makes independent investment decisions on behalf of the client.

Only a small portion of income comes from interest-bearing transactions or proprietary trading. This makes Julius Bär an “asset-light bank,” i.e., a company that operates with relatively low risk. However, the rules of the markets also apply to it. As its business model is heavily dependent on developments in the financial markets, Julius Bär is sensitive to price fluctuations, geopolitical risks, and changes in global wealth accumulation. To guard against this, the bank attaches great importance to strong risk management and a strict compliance culture.

Market and competition

The global asset management market has grown significantly in recent years. Several hundred trillion US dollars in private assets are now managed worldwide, and the number of wealthy individuals is also rising steadily, particularly in Asia and emerging markets in general. While European markets are largely saturated, many new business opportunities are emerging in countries such as Singapore, Hong Kong, China, and India. This is precisely why Asia has been one of Julius Bär's most important growth regions for years. And the company has already done a good job, as the geographical distribution of revenues shows. The Asia region is already the most important market after Switzerland. Revenues of over one billion Swiss francs were recently generated there. This is followed by Europe with around 800 million Swiss francs and the relatively insignificant Americas region with only a mid-double-digit million amount.

Several important trends are shaping the asset management market: On the one hand, the globalization of assets continues to increase—many clients now own assets in several countries and want international advice. On the other hand, digital solutions are growing in importance as clients demand greater transparency and easy access to their investments. Sustainable investing (ESG) is also becoming increasingly important. Due to climate issues, many clients today want to invest their assets responsibly and do some good. Added to this is an impending generational change. In the coming years, a large portion of global wealth will pass to the younger generation, which is more digital, more international, and more risk-tolerant. Julius Bär is already responding to these developments with a clear strategy based on three pillars: Focus, growth, and innovation. The focus is on the core business of wealth management, which is to be continuously expanded. The bank aims to achieve growth by acquiring new clients and expanding into international markets, particularly in Asia. Innovation means investing in digitalization and new technologies to simplify processes, better serve clients, and offer new forms of investment—in other words, deepening the moat.

However, the greatest opportunities continue to lie in the growth of global wealth, rising demand for sustainable and digital investments, and the bank's strong position as a trusted partner to wealthy clients. Risks, on the other hand, include market volatility, geopolitical uncertainties, stricter regulations, and increasing competition from digital providers. Yes, new digital providers and fintech companies offering automated investment solutions and cryptocurrencies are constantly entering the market. Examples include SwissBorg and Enfusion. This is increasing pressure on traditional banks to modernize their digital offerings and upgrade their technology.

Source: Julius Bär peer comparison

Competition among asset managers is also very intense. Low barriers to market entry and the trend toward passive investing with ETF products are creating strong headwinds and intense competition. As a specialized institution, Julius Bär does not compete with major players such as BlackRock, but rather with large private banks such as UBS, Pictet, Lombard Odier, Rothschild & Co., and international firms such as Morgan Stanley and J.P. Morgan Private Bank. In contrast to the market for ETFs, it is not so much prices that play a role here, but rather trust, discretion, personal service, and the quality of investment advice. It is also a people business in which key advisors have built close relationships of trust with their clients.

Julius Bär's latest quarterly figures from June 2025

Julius Bär attracted a healthy amount of client money in the first half of 2025. The bank recorded net new money inflows of CHF 7.9 billion, which was double the figure for the previous year. Particularly strong inflows came from the core markets of Asia (especially Hong Kong, Singapore, and India), Western Europe (including the UK, Ireland, and Germany), and the Middle East. This shows that client demand remains stable and growth-oriented in all key regions. Assets under management totaled CHF 483 billion at the end of June 2025. Although this figure was slightly below the level at the end of 2024, average monthly client assets rose by seven percent year-on-year. This was due to high inflows of new money and the positive performance of the stock markets, which offset the impact of a weaker US dollar and the sale of the Brazilian business.

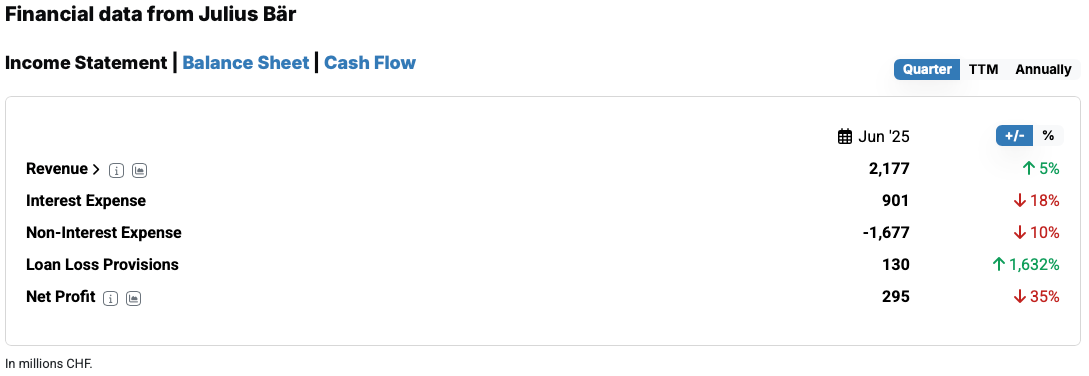

Source: Financial data

In operational terms, Julius Bär is presenting itself as a robust and increasingly efficient business. Revenue improved by 5 percent to CHF 2.2 billion in the second quarter. Interest expense was reduced by 18 percent to EUR 901 million, while non-interest expense was reduced by 10 percent to CHF 1.7 billion. This positive development is attributable to higher income from client activity and initial noticeable cost savings. The cost-income ratio, i.e., the ratio of expenses to income, improved to 68 percent (after 71 percent in the previous year). The bank is thus ahead of schedule and expects to exceed its target of CHF 130 million in gross cost savings by the end of 2025.

Despite this progress, reported IFRS profit was impacted by one-off special factors. These include higher loan loss provisions and an accounting effect from the sale of the subsidiary Julius Bär Brazil, which had no impact on liquidity. As a result of these factors, consolidated profit under IFRS fell by 35 percent to CHF 295 million. Adjusted for these effects, however, the operating result shows a clear improvement.

The bank's capital and liquidity position also remains solid. With a CET1 (Common Equity Tier 1) capital ratio of 15.6 percent, a total capital ratio of 22.3 percent, and a liquidity coverage ratio of 303 percent, Julius Bär significantly exceeds the minimum regulatory requirements.

Source: Financial data

The strong and highly liquid balance sheet gives the bank stability and flexibility for further growth. Further progress was also made in the operational area. In order to become more agile and cost-efficient, the bank simplified its organization, strengthened its risk management, and adapted its operating model, for example.

Julius Bär stock forecast for 2025

The 2025 half-year report did not provide a specific outlook for the 2025 financial year. However, the bank has already set itself ambitious targets in the past, which were outlined in more detail in the strategy update in summer 2025, among other places. According to this, the Swiss asset manager aims to achieve a cost-income ratio of less than 67 percent between 2026 and 2028, while at the same time achieving annual net new money growth of around 4 to 5 percent. It also aims to achieve an adjusted return on CET1 capital of at least 30 percent in the 2026 to 2028 cycle. To achieve these goals, processes are being modernized and the IT infrastructure is being continuously optimized. Around CHF 400 million is to be invested in technology for this purpose between 2023 and 2025.

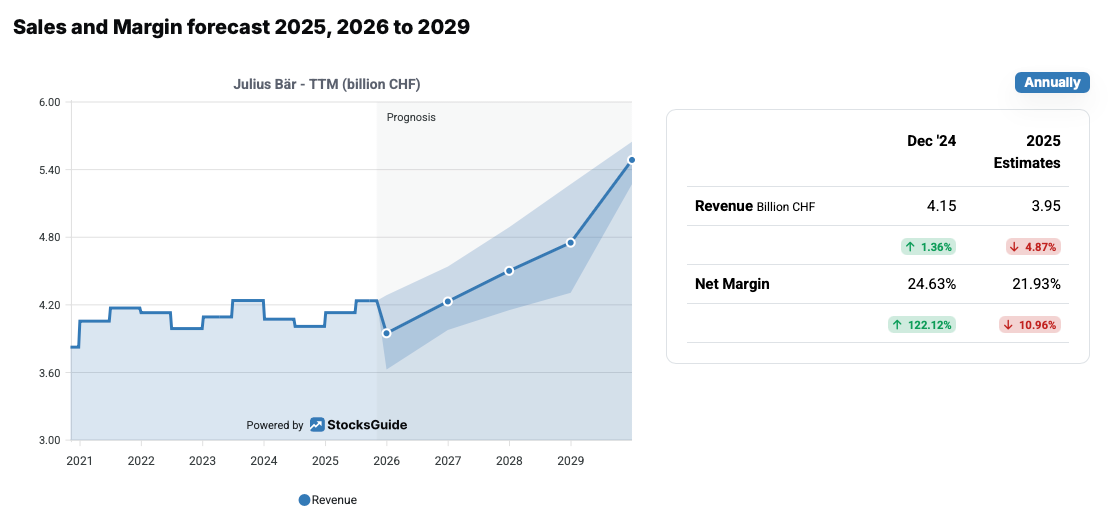

Source: Sales and Margin forecast

A look at analysts' forecasts shows that they also consider further growth to be likely. This could mean that sales, which have been moving sideways for years, could break out of their corridor and return to their long-term growth path. However, double-digit sales growth is not to be expected here either. In the future, however, it could be in the high single-digit range. Earnings are also likely to rise. By 2028, profits are expected to be 30 percent higher than in 2024.

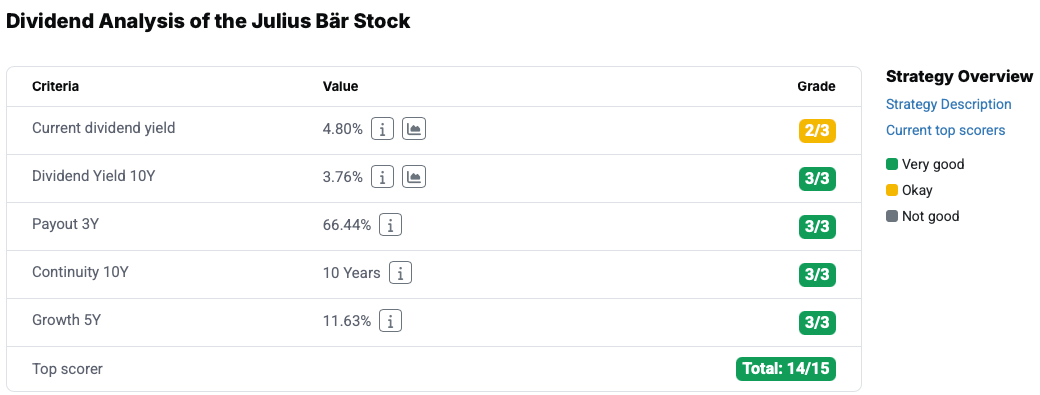

Key figures for Julius Bär stock from the dividend analysis

The dividend analysis of Julius Bär stock shows that the bank has been offering its shareholders stable dividends and an attractive distribution policy for many years. With a current dividend yield of 4.8 percent, the stock is well above the average for many Swiss financial stocks. This value is also in the upper range among global bank stock. In the dividend analysis, the stock receives 2 out of 3 possible points for this. Over a period of ten years, the average dividend yield is 3.8 percent, which this time is rated with the maximum score of 3 points. This shows that Julius Bär has regularly paid its shareholders an attractive dividend, even in volatile market phases. It is particularly positive that the distributions did not come from the company's assets. The payout ratio – i.e., the proportion of profits distributed as dividends – has been 66 percent over the last three years. This means that the bank uses only around two-thirds of its net profit for dividend payments. This is a balanced figure that rewards shareholders on the one hand and leaves sufficient capital for further growth and reserves on the other. This figure also receives 3 out of 3 points in the dividend analysis.

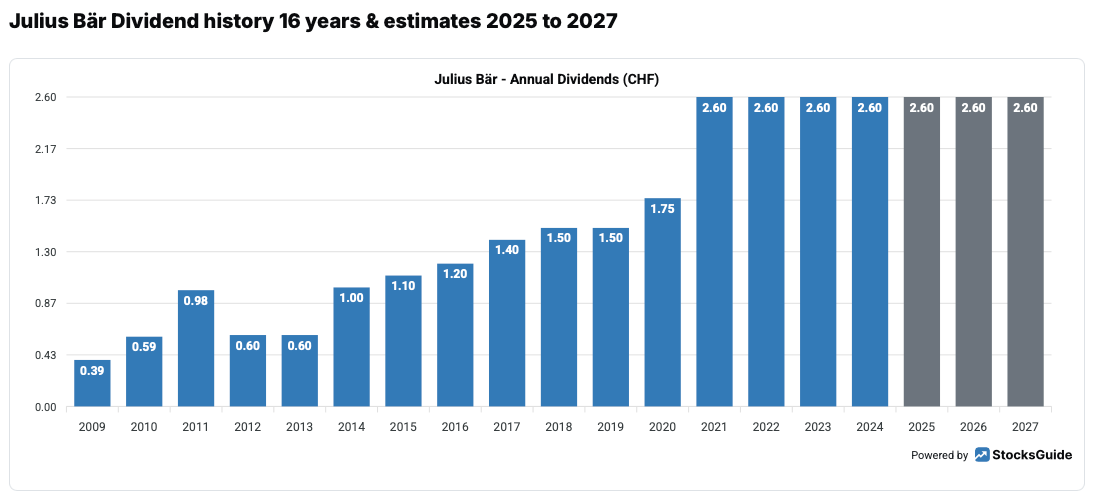

Source: Julius Bär dividend history

The continuity of dividend payments is also particularly positive: Julius Bär has paid dividends without interruption for more than ten years and has increased them regularly until 2021. This consistency is a strong sign of stability and confidence in the financial sector, which is why this category also scores 3 out of 3 points. However, it has not always been a steady upward trend. For example, there was once a hefty dividend cut.

In terms of dividend growth, however, the bank is once again convincing across the board. Over the last five years, the dividend has risen by an average of 11.6 percent per year. This also earns it 3 out of 3 points.

Source: Dividend analysis

Overall, Julius Bär has an extremely solid dividend history with rising dividends. However, since 2021, the era of increased dividends seems to have come to an end for the time being. Since then, the dividend has remained at a level of 2.60 Swiss francs. No increase is expected in the future either. In the long term, however, this could be expected again if the operational progress initiated to improve the cost-income ratio is confirmed. Expected growth in net new money is also likely to create corresponding potential for long-term dividend increases after 2028.

Valuation of Julius Bär stock

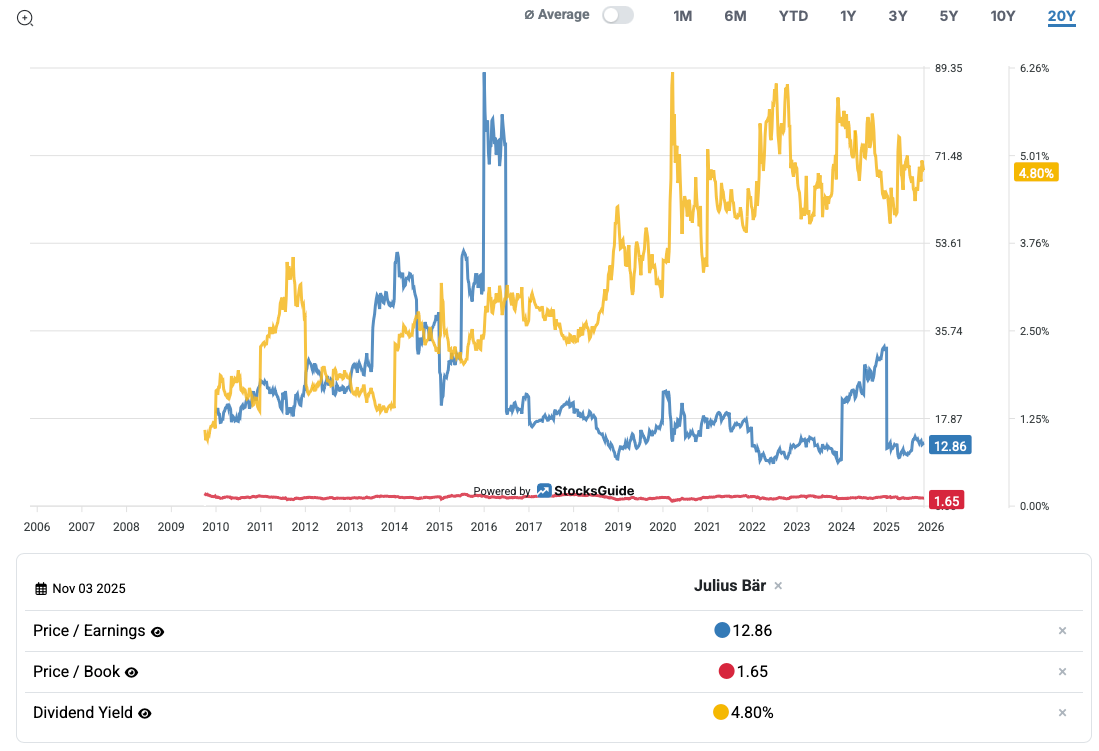

Looking at the valuation of Julius Bär stock, they do not appear expensive with an expected P/E ratio of 12.6 and a dividend yield of 4.9 percent. The book value of 1.6 shows that the stock is neither cheap nor expensive.

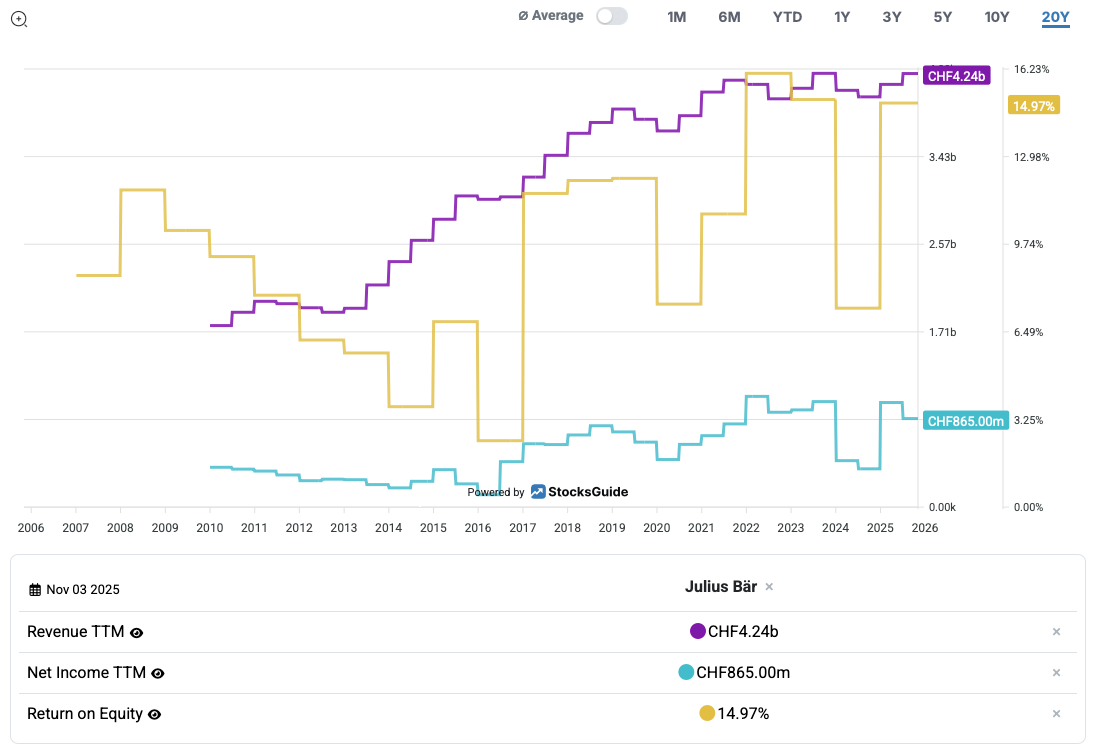

Source: StocksGuide Charts

However, a historical comparison shows that the stock price has become increasingly cheaper. Investors should be wary, as this may also be due to a weakening of the operating figures. Looking at the operating metrics, this can only be confirmed to a limited extent.

Source: StocksGuide Charts

At CHF 4.2 billion, revenue over the last twelve months is significantly higher than it was 15 years ago. The same applies to net profit. Profitability is also currently at a high level that many banks can only dream of. Of course, the results are subject to strong fluctuations. After all, this is a cyclical financial asset. However, my analysis shows me that the decline in valuation is mainly due to the environment and less to the development of operating figures.

Conclusion on Julius Bär stock

Julius Bär Group stock is a solid, high-yielding and attractive long-term investment in the Swiss financial sector. The bank's business model is clearly focused on wealth management, an area that generates stable and recurring income and is less sensitive to economic cycles than traditional lending. The latest financial results show strong operating performance, growing client inflows, and a solid capital base. The dividend policy is particularly attractive. With a current yield of around 4.9 percent, long-term dividend growth, and continuous distributions over a period of ten years, Julius Bär demonstrates reliability to its shareholders. The moderate payout ratio of around 66 percent also leaves room for investment in growth and digitalization. In the long term, growth could also lead to an increase in dividends. This is supported by structural growth in global wealth management, particularly in Asia. However, the bank's excellent reputation as a discreet, independent asset manager can also be helpful in an industry that is heavily influenced by cost pressures.

At the same time, however, there are risks posed by market fluctuations, geopolitical uncertainties, and increasing digital competition. The biggest drawback, however, could be the size of the bank itself. With a market capitalization of only CHF 10 billion, it is an extremely small player that has little cost advantage over the major players. This makes it all the more important for the future to achieve an attractive cost-income ratio. Nevertheless, there could be considerable consolidation potential for Julius Bär. After all, the asset management market is still very fragmented, and there are numerous smaller institutions with significantly fewer assets under management.

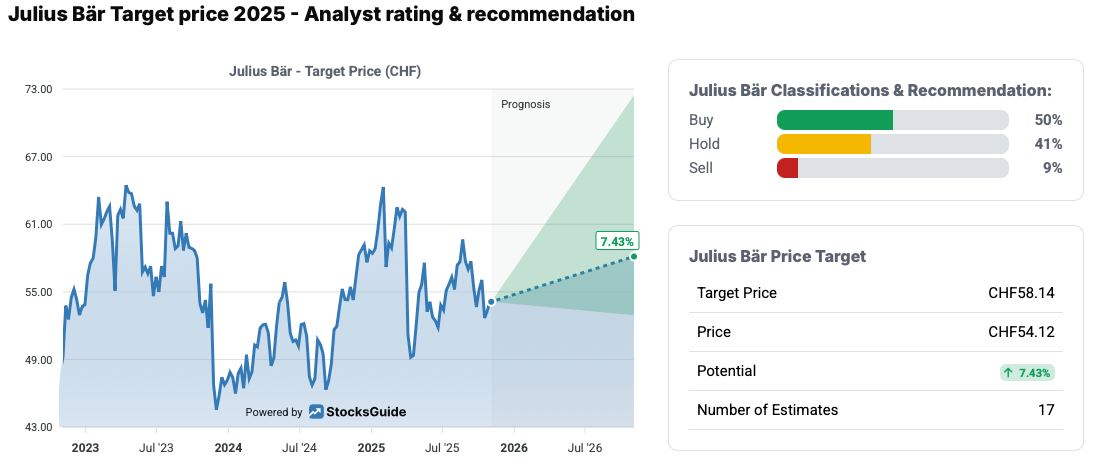

Source: Julius Bär target price

Analysts' assessments of Julius Bär stock is predominantly positive. Around 50 percent of analysts recommend buying the stock, 41 percent advise holding, and only nine percent give a sell signal. The average price target is CHF 58.14, which corresponds to a price potential of around 7.3 percent compared to the current price of CHF 58.43. Analysts therefore see moderate upside potential, especially if Julius Bär succeeds in consistently implementing cost reductions and continuing to grow new money. Those seeking more certainty when entering the market can set up an alert for the stock. A price of 45 Swiss francs would be below the average of recent years and represent a further risk buffer of 23 percent.

🔔 If you would like to receive weekly investment ideas and free stock analyses selected according to the Levermann, high-growth investing, or dividend strategies by email, you can subscribe to our free StocksGuide Insider now.

The author and/or persons or companies associated with StocksGuide own or may own shares of Julius Bär. This article represents an expression of opinion and does not constitute investment advice. Please note the legal information.