Table of contents

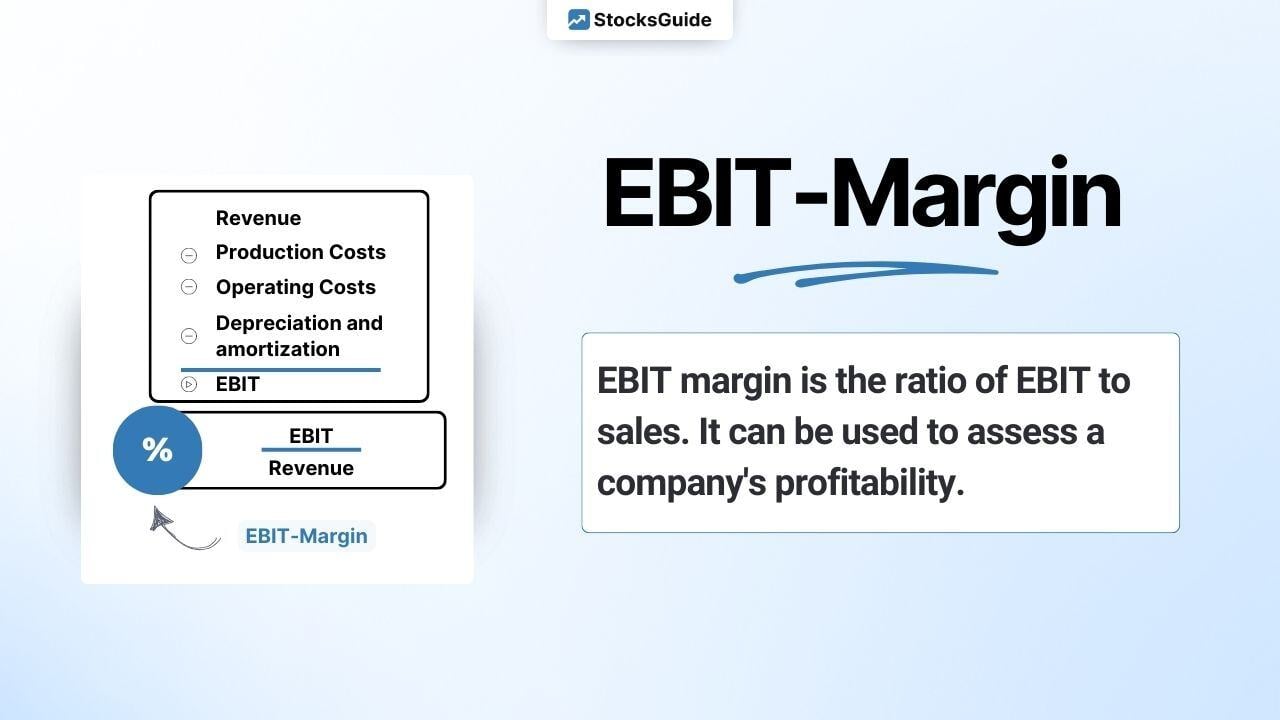

What is the EBIT margin?

The EBIT margin is the ratio of EBIT to sales. This allows the profitability of a company to be assessed. The ratio is internationally meaningful, as the use of EBIT excludes national tax and financing conditions from the result.

EBIT represents the operating result and revenue the sum of all a company's income.

The calculation can be based on different time periods (e.g. last financial year or TTM). TTM is the abbreviation for “Trailing Twelve Months” and reflects the operating result over the last 12 months or 4 quarters.

How is the EBIT margin calculated?

EBIT is divided by sales for the same period.

Calculate EBIT:

The calculation of the EBIT margin (TTM) of Facebook shares as at October 15, 2021 is shown as an illustration:

In stocksguide you will find the EBIT margin for each share as a key figure of the Levermann strategy and on the “Overview” tab under financial data in the income statement.

According to the Levermann strategy, the following points are awarded for the EBIT margin key figure:

The calculation of the EBIT margin is shown in the income statement (red box):

What does the EBIT margin mean?

The EBIT margin serves as a benchmark for the profitability of a company. For example, it provides a good assessment of whether the company will quickly become loss-making or very profitable if costs rise or sales fall.

Whether the EBIT margin under consideration is good or bad also depends on other influencing factors, e.g:

- long-term development of the EBIT margin

- EBIT margin compared to the competition

- Future prospects of a company's industry

- Position of the company in this market

- Speed of growth

- Business model

Top 10 stocks with the highest EBIT margin worldwide

The following table shows the top 10 mid and large cap stocks with a high EBIT margin.

| Stock | EBIT margin |

| Porsche Holding Vz. | 99.31% |

| Vici Properties Inc | 92.66% |

| Power Assets Holdings Limited | 87.54% |

| Ares Capital Corporation | 86.47% |

| Interactive Brokers Group, Inc. Class A | 84.87% |

| Kweichow Moutai | 79.47% |

| Sagax | 78.53% |

| Texas Pacific Land Trust | 78.43% |

| Gaming and Leisure Properties, Inc. | 74.90% |

| Segro | 72.75% |