Table of contents

What is shareholder's equity?

Shareholder's equity is the portion of total assets that is made available to the company by its shareholders for an indefinite period of time.

The terms net assets and book value are often used as synonyms for equity. In simplified terms, the following thesis can be put forward: If all of a company's assets are sold and its debts repaid, equity remains.

In a company's balance sheet, equity can be found on the liabilities side next to debt capital.

The picture shows an example of the balance sheet of BHP Group stock (equity in the red box):

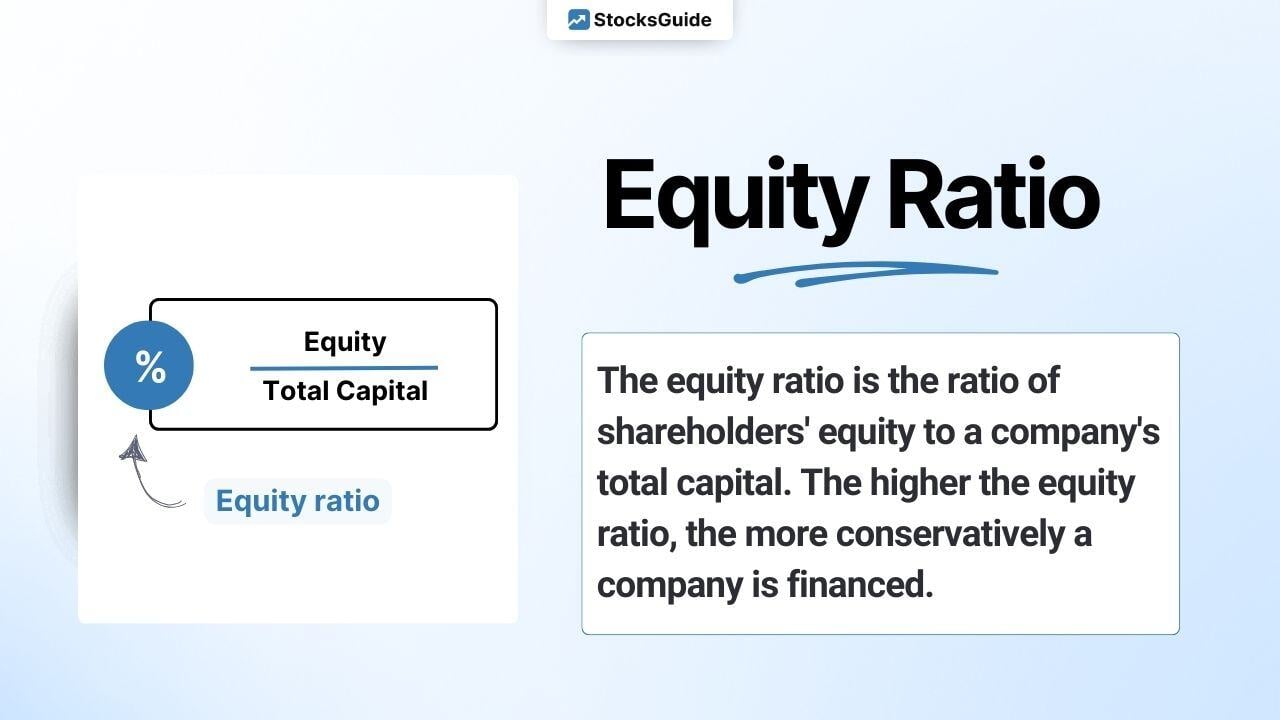

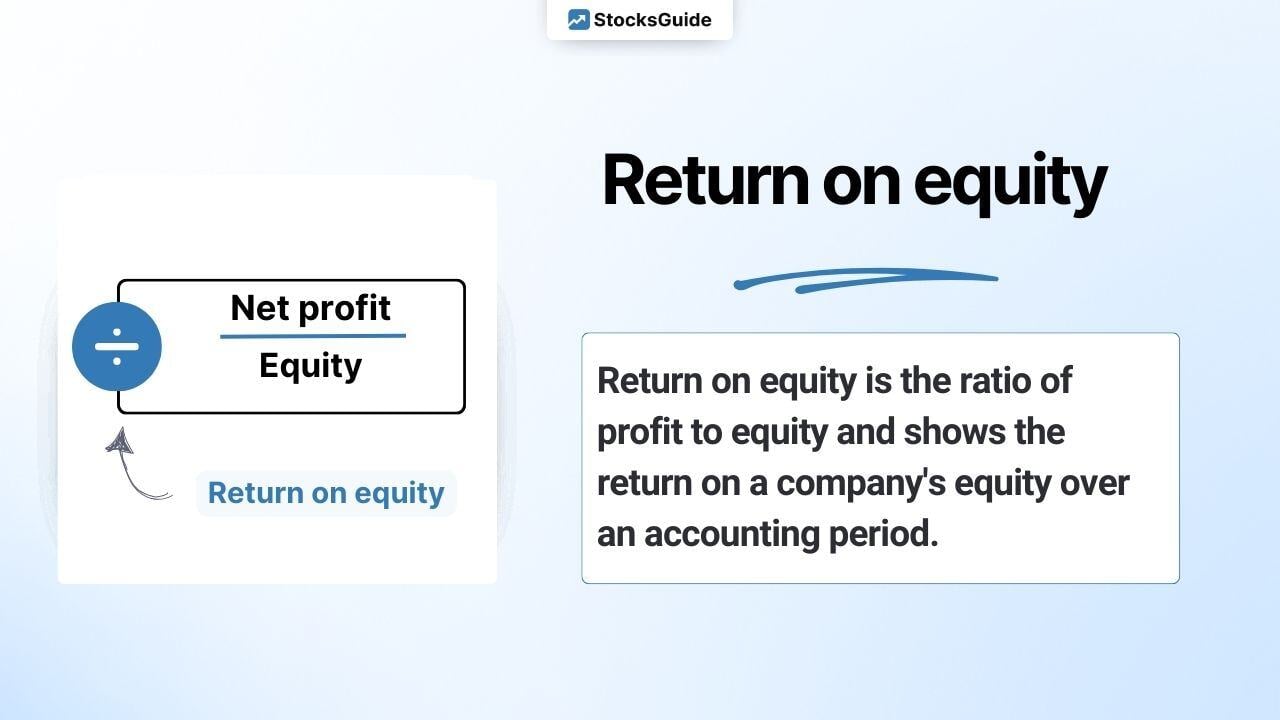

The return on equity and the equity ratio can be calculated on the basis of equity.

How is equity calculated?

A detailed look at equity in the balance sheet reveals that equity is made up of the following components (German Commercial Code §266): Subscribed capital, capital reserves, retained earnings, profit/loss carried forward and net profit/loss for the year.

Calculate equity:

Subscribed capital

+ capital reserve

+ retained earnings

+ profit/loss carried forward

+ net profit/loss for the year

= Shareholders' equity

Equity components

Subscribed capital

Subscribed capital is created when a company is founded and when capital is increased through payments by shareholders. Subscribed capital corresponds to the nominal value of the shares. In the case of a public limited company, it is also referred to as share capital or liable capital.

Capital reserve

As a rule, a higher price than the nominal value alone is paid for the newly issued shares in a capital increase. The amount in excess of the nominal value flows into the capital reserve as a premium. According to Section 272 (2) of the German Commercial Code, it is mandatory to form capital reserves. These are permanent and cannot simply be distributed to shareholders again in the future.

Retained earnings

In contrast, the revenue reserves shown in the balance sheet consist mainly of retained earnings. These can be distributed to shareholders in the future.

Profit carried forward/loss carried forward

A profit or loss carried forward is the transfer of profit or loss to the next financial year. This can happen if there is no clarity among shareholders as to what should be done with the profit. Profits carried forward increase equity and losses carried forward reduce equity.

Net profit/loss for the year

The net profit or loss for the year in the balance sheet is the company's profit or loss for the current period (after deducting any costs and taxes). This is then available for appropriation and can either be transferred to retained earnings or distributed to shareholders as a dividend.

Top 10 stocks with the highest equity worldwide

The following table shows shares with the highest equity in the world.

| Stock | Equity |

| Berkshire Hathaway | $607.94b |

| Industrial and Commercial Bank of China | $508.16b |

| Saudi Aramco | $454.27b |

| China Construction Bank Corporation Class H | $428.40b |

| Bank of China | $353.55b |

| JPMorgan Chase & Co. | $340.54b |

| Alphabet | $300.74b |

| Bank of America | $293.88b |

| Samsung | $278.69b |

| ExxonMobil | $276.25b |