Table of Contents

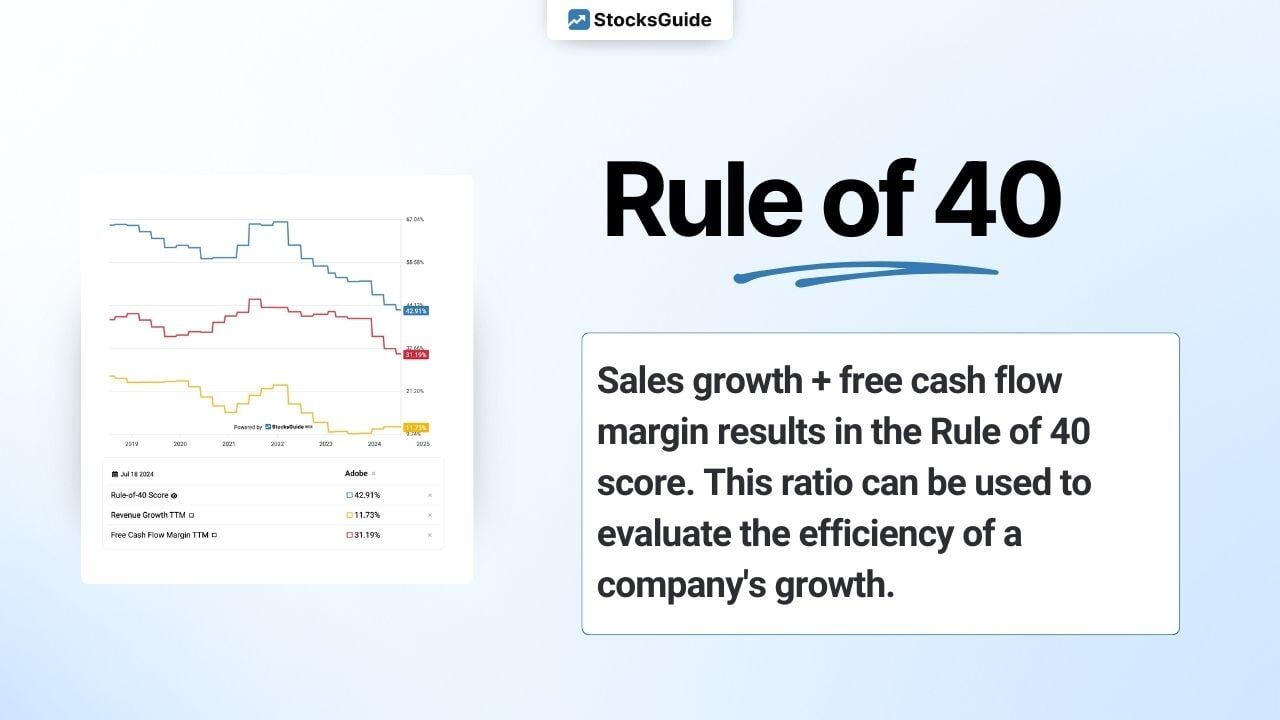

What is the Rule of 40?

The Rule of 40 score is the sum of revenue growth and free cash flow margin. If the sum is 40% or higher, the Rule of 40 is fulfilled. This metric evaluates the efficiency of a company's growth.

A higher score indicates a more attractive business model. Values above 40% are considered exceptional. Companies with a score above 40% over several years exhibit particularly healthy growth.

How is the Rule of 40 Calculated?

The Rule of 40 is calculated by summing revenue growth (TTM) and free cash flow margin.

Example Calculation (Pinterest, 16 February 2022):

This shows Pinterest mostly meets the Rule of 40, indicating its strong growth.

Pinterest receives 3 points due to a Rule of 40 score above 40%.

Note: For young companies, closely monitor free cash flow margin development. If revenue growth slows and profitability (positive free cash flow) isn't quickly achieved, the Rule of 40 might no longer be met, potentially leading to a significant drop in stock price.

What Does the Rule of 40 Indicate?

Companies with a Rule of 40 score of 40% or higher are characterized by efficient growth. This metric is useful for evaluating high-growth companies, including those that are not yet profitable (negative free cash flow margin) but have high revenue growth.

Example: A company with a free cash flow margin of -20% and revenue growth of +60% meets the Rule of 40 (-20% + 60% = 40%).

An unprofitable company with a high Rule of 40 score can be more attractive than a profitable company with low growth. It is crucial that a profitable free cash flow margin is achieved if revenue growth slows. For young companies, the Rule of 40 score should remain constant or increase. As companies grow, maintaining a score above 40% becomes more challenging.

Don't Lose Sight of Valuation

Companies that meet the Rule of 40 over several years are rare, making them highly valued and sought after by investors. As of 15 February 2022, 56 of the NASDAQ-100 stocks meet the Rule of 40, but only 10 have a P/E ratio below 20!

Note: The Rule of 40 is just one metric for evaluating stocks. Other metrics like EV/Sales or EV/FCF should also be considered.

Caution: When calculating the Rule of 40 score, only organic revenue growth should be considered. For companies with significant revenue growth due to acquisitions, this metric may be distorted by inorganic growth.

Top 10 stocks with the highest Rule of 40 score worldwide

The following table shows the top 10 stocks with a high Rule of 40 score from the Software/Internet sector:

Updated on: Wed, 07.08.2024

| Stock | Rule-of-40 |

| Marathon Digital | 247.15 % |

| TeraWulf | 203.77 % |

| Nordnet Registered | 185.23 % |

| Grindr | 169.98 % |

| Coinbase Global | 134.35 % |

| DLocal | 88.29 % |

| Baltic Classifieds Group | 88.03 % |

| Duolingo | 79.25 |

| Clear Secure | 71.05 % |

| TGS ASA | 70.02 % |