Table of Contents

- What is ROCE?

- Why is ROCE important?

- Example: ROCE of Microsoft?

- Why is ROCE important for value investors?

- What investors can learn from this

- Conclusion

What is ROCE? 🤔

ROCE stands for return on capital employed. This key figure shows how efficiently a company uses the capital at its disposal to generate operating profits – in other words, what is actually earned in the course of business.

The formula is:

ROCE = EBIT/capital employed

- EBIT = earnings before interest and taxes (operating profit)

- Capital employed = total capital minus current liabilities

In contrast to ROCE, ROIC (return on invested capital) only takes into account operating capital invested – i.e. only the capital that is directly used to generate operating profits. This makes ROIC particularly well suited for assessing the pure efficiency of the core business – independently of non-operating assets or the company's capital structure.

Why is ROCE important? ☝️

ROCE gives investors a clear answer to the question:

‘How efficiently does a company manage its invested capital?’

A high ROCE means that a company generates a lot of operating profit from relatively little capital – in other words, it operates particularly efficiently. A falling ROCE, on the other hand, can be a warning sign – for example, of unprofitable investments or declining operating strength.

Example: ROCE of Microsoft 📈

Microsoft is a good example of a company with a high return on capital employed. Its current ROCE is 27.2%.

Calculation

We calculate the ROCE of Microsoft using the familiar formula:

ROCE = EBIT/capital employed

Step 1: Determine EBIT

According to the current annual report, Microsoft's EBIT (earnings before interest and taxes) is:

EBIT = $122.13 billion

Step 2: Use capital employed

The capital employed – i.e. the total capital ($562.64 billion) minus current liabilities ($114.21 billion) – is:

Capital employed = $448.44 billion

Step 3: Calculate ROCE

ROCE = EBIT/capital employed = $122.13 billion/$448.44 billion = 27.2%

Microsoft therefore generates around 27 cents of operating profit for every dollar of capital employed – a strong figure.

Why is ROCE important for value investors? 💡

Value investors look for companies that are sustainably profitable and use their capital efficiently. This is exactly where ROCE comes in: the ratio not only shows whether a company is making a profit, but also how much return it achieves on every dollar of capital employed.

A consistently high ROCE can indicate that a company has a robust business model, competitive advantages (moat) and good management decisions. For value investors, ROCE is therefore a key indicator of real return on capital – and a strong selection criterion for long-term investments.

What investors can learn from this 🤓

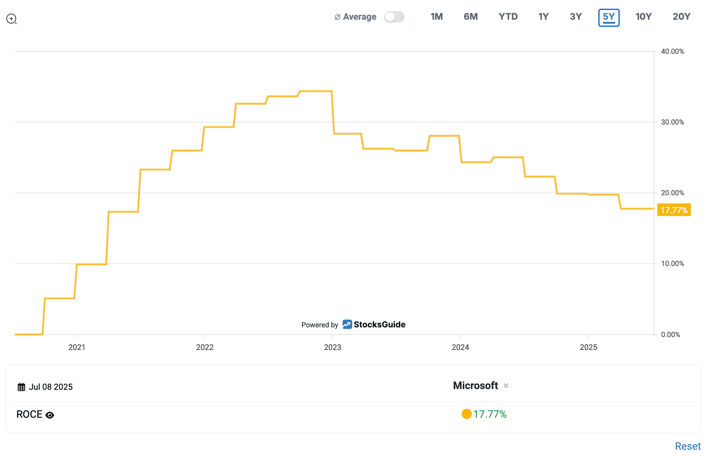

A ROCE of 27.2% shows that Microsoft is extremely efficient in its use of capital. Such figures are a strong indication that the company is well managed and makes good use of its resources.

However, even a high ROCE should be monitored over time. A decline may indicate high investments that are not (yet) paying off – or operational weaknesses in the core business.

Conclusion

The ROCE ratio shows at a glance how efficiently a company is working with its invested capital. It is an indispensable tool for investors, especially when comparing capital-intensive business models.

👉 How to use ROCE in stock analysis:

✅ Compare ROCE values over several years.

✅ Look for stable or rising values – a sign of operational strength.

✅ Use ROCE in industry comparisons: Who is working more efficiently?

Tip: In the StocksGuide Charts, you can compare the ROCE of thousands of companies at a glance and analyse them visually. This allows you to quickly identify particularly efficient companies and make more informed decisions on the stock market.

With the StocksGuide Screener, you can filter the most attractive stocks in just a few clicks – based on ROCE and over 40 other key figures.

Here you will find an overview of interesting companies based on value investing principles including an attractive ROCE. Take a look now!