Table of contents

What is the debt ratio?

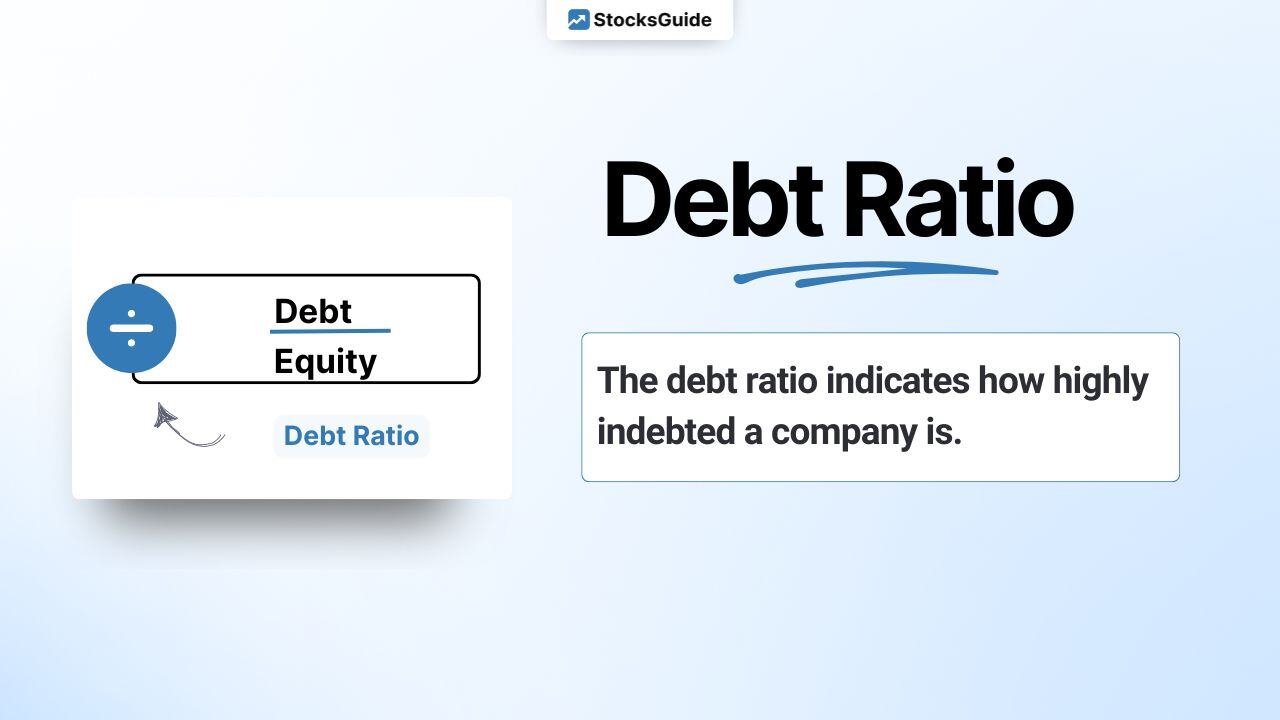

The debt ratio indicates how highly indebted a company is. There are companies with low levels of debt that have a high level of cash and can easily pay off their debts. In contrast, there are also companies that can barely manage their high debts.

How is the debt ratio calculated?

In stocks.guide, debt is calculated as follows according to the High Growth Investing strategy:

Debt-equity ratio = debt / equity

The sum of current and non-current liabilities is set in relation to equity. The most recent quarterly figures are used for the calculation.

What does the debt ratio mean?

A debt ratio of less than 1 indicates a low level of debt. A debt ratio greater than 2 indicates possible risks from debt. Companies with a low debt ratio tend to be less risky. However, the debt ratio can be subject to high fluctuations.

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)