Table of Contents

- What is the Price-to-Book Ratio (P/B)?

- How is the Price-to-Book Ratio Calculated?

- What Does the Price-to-Book Ratio Indicate?

What is the Price-to-Book Ratio (P/B)?

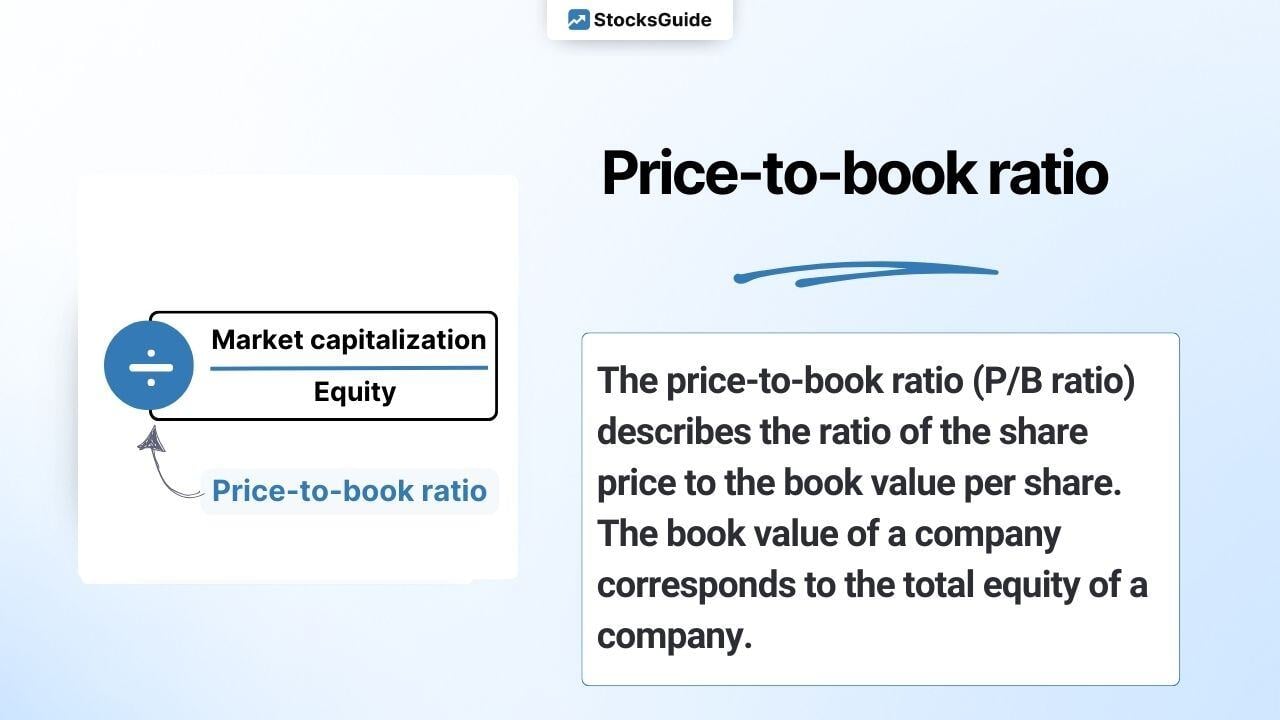

The Price-to-Book Ratio (P/B) measures the market value of a stock relative to its book value per share. The book value represents the company's equity. The P/B ratio is an important metric for evaluating a company's value.

Generally, a lower P/B ratio indicates that a stock is undervalued.

The price-to-book ratio is based on the market capitalization and the book value (net assets) of a company.

Accordingly, the P/B ratio is made up of 2 components:

(1) Share price divided by the (2) book value per share

Or to put it another way:

(1) Market capitalization divided by (2) Shareholders' equity

How is the Price-to-Book Ratio Calculated?

The price-to-book ratio (P/B ratio) is the ratio of the share price to the book value per share. In other words, market capitalization is divided by equity.

Example Calculation: Realty Income stock has a P/B ratio of 1.32 as of June 26, 2025.

The Realty Income share is currently valued at a P/B ratio of 1.32. For comparison, you can/should take a look at companies from the same sector:

.png?width=700&height=400&name=Bildschirmfoto%202025-06-26%20um%2009.35.51%20(2).png)

What Does the Price-to-Book Ratio Indicate?

The price-to-book ratio (P/B ratio) shows the premium investors are willing to pay on equity. This allows conclusions to be drawn about the valuation of a share or company. A high P/B ratio indicates a high valuation and a low P/B ratio indicates a favorable valuation.

The price-to-book ratio (P/B ratio) shows the premium investors are willing to pay on equity. This allows conclusions to be drawn about the valuation of a share or company. A high P/B ratio indicates a high valuation and a low P/B ratio indicates a favorable valuation.

But be careful:

A P/B ratio of less than 1 does not necessarily indicate a good investment! In theory, you could buy such a company, then sell all its assets and make a profit. However, this is (usually) only the case in theory. In general, if the P/B ratio is less than 1, the market assumes that the equity will be reduced by losses in the future. It is therefore important to consider the P/B ratio in the overall context and not in isolation.

In addition, the price-to-book ratio does not take into account hidden reserves or charges. As a result, the P/B ratio loses its informative value, particularly in the case of investment companies.

In the case of technology companies, the P/B ratio is often not very meaningful:

For example, the value of a software company is determined to a large extent by its intellectual property. However, this often does not appear in the balance sheet at all if it was created in-house (and not purchased). The network effects that make up the value of platform companies, for example, are also not reflected in the book value.

Top 10 stocks with low price-to-book ratios (P/B) worldwide

The following table shows mid and large cap stocks with the lowest price-to-book ratios worldwide. Shares from the financial sector were not considered.

| Stock | Price-to-Book-ratio |

| Swatch (N) | 0.11 |

| Samsung SDI | 0.15 |

| Volkswagen VZ | 0.24 |

| Nissan Motor | 0.24 |

| Vipshop | 0.27 |

| Korea Electric Power Corporation Sponsored ADR | 0.28 |

| Porsche Holding Vz. | 0.29 |

| Stellantis | 0.30 |

| Volvo Car | 0.34 |

| CK Hutchison Holdings Ltd | 0.35 |

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)