Table of Contents

- What is Free Cash Flow?

- How is Free Cash Flow Calculated?

- What Does Free Cash Flow Indicate?

- Difference Between Net Profit and Free Cash Flow?

- Advantage of Free Cash Flow over Profit (EBIT)?

What is Free Cash Flow?

Free Cash Flow (FCF) indicates the amount of generated profit available for dividend distributions, share buybacks, or debt repayment at the end of a financial period. FCF can be negative if direct and indirect costs, as well as investments, exceed inflows. A company with high investments typically has lower FCF. The term "Free Cash Flow" comes from the Anglo-Saxon area and means free payment flow or free cash flow.

In general, the higher the free cash flow, the more profitable the company is.

Free cash flow is often set in relation to revenue to make it easier to compare companies with one another. This gives you the free cash flow margin. The formula for the free cash flow margin is as follows:

How is Free Cash Flow Calculated?

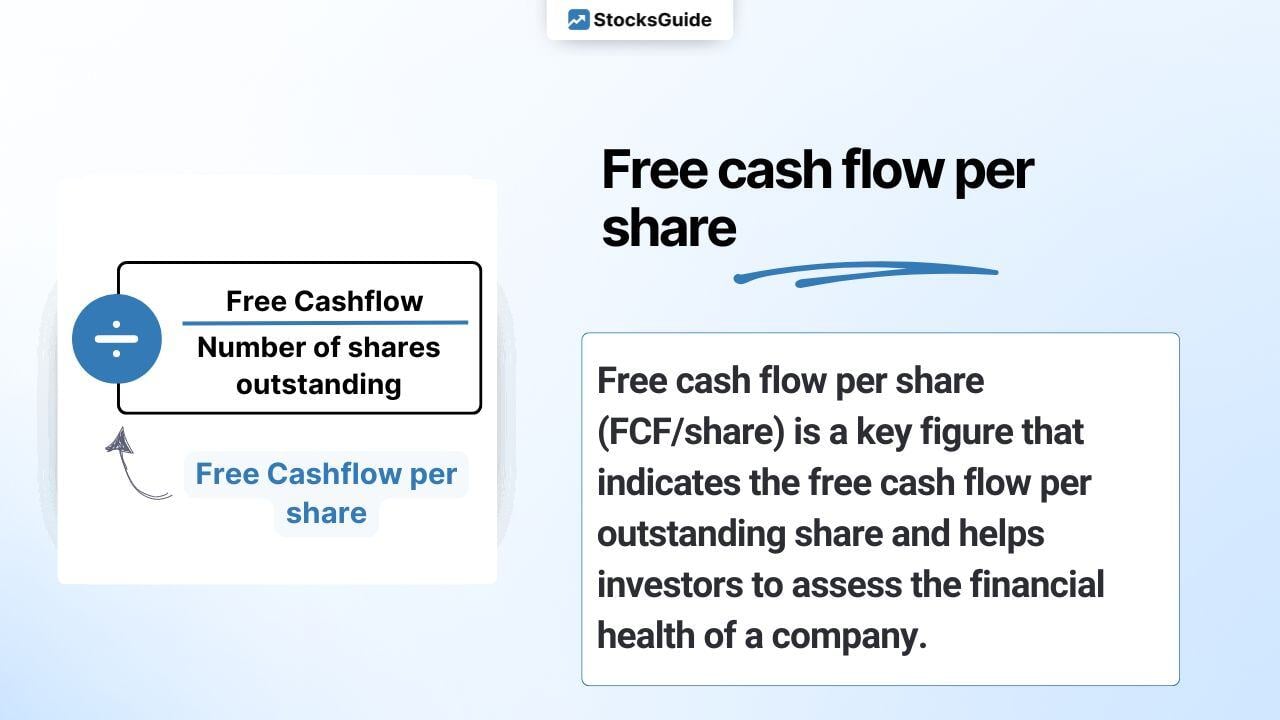

Free cash flow is calculated by subtracting cash flow from investing activities from operating cash flow.

In the stocks.guide you will find, among other things, the free cash flow (TTM). TTM is the abbreviation for "Trailing Twelve Months". By taking the last 12 months into account, the latest figures from the last 4 quarterly reports are always taken into account.

Calculate free cash flow (FCF):

The calculation of the free cash flow is shown in simplified form to illustrate this:

Net profit for the year

+/- depreciation and amortization, changes in provisions, other non-cash expenses/income and change in net working capital

= Operating cash flow

- Cash flow from investing activities

= Free cash flow

The free cash flow development of Apple, Microsoft and NVIDIA shares as at September 13, 2024 is shown as an illustration:

What Does Free Cash Flow Indicate?

Free Cash Flow shows the funds available for dividend payouts, share buybacks, or debt repayment. FCF often differs significantly from net profit. Many fast-growing companies show positive FCF despite significant losses in the income statement.

Example: Okta has positive FCF while net profit, EBIT, and EBITDA are negative.

Note: Despite the greater informative value of the free cash flow, you should always keep an eye on the income statement. In addition, the cash flow statement is not fully standardized.

Difference Between Net Profit and Free Cash Flow?

The income statement is distorted by non-cash expenses and income (e.g., depreciation). EBIT is subject to accounting policies. Thus, the cash flow statement plays a crucial role in stock analysis. Stock options in employee compensation appear as personnel costs affecting operating profit but not cash flow. Additionally, an increase in accounts receivable raises revenue and profit but does not affect cash flow until paid.

Advantage of Free Cash Flow over Profit (EBIT)?

Many professional investors prefer FCF over EBIT or net profit for profitability analysis as it better indicates a company's dependence on external financing. FCF is less manipulable by management compared to profit or EBIT due to its independence from other financial metrics.

Top 10 stocks with the highest free cash flow worldwide

The following table shows the top 10 shares with the highest free cash flow in the world. For direct comparison, we also show you the EBIT and operating result (except for shares from the financial sector):

| Stock | Free Cashflow TTM | EBIT TTM |

| Apple | $104.34b | $120.59b |

| Saudi Aramco | $91.57b | $224.53b |

| Microsoft | $74.07b | $109.43b |

| Alphabet | $60.79b | $99.08b |

| Meta Platforms | $49.64b | $60.65b |

| Amazon.com | $48.34b | $55.10b |

| NVIDIA | $39.33b | $47.74b |

| ExxonMobil | $32.41b | $41.93b |

| Shell | $29.15b | $28.29b |

| Petroleo Brasileiro SA | $27.80b | $38.11b |

%20%F0%9F%87%BA%F0%9F%87%B8.jpg)